HGAR and NYSAR Celebrate Legislative Wins, Prepare for 2026 Advocacy Push

With the full legislature and governor facing re-election in 2026, HGAR and NYSAR are already preparing for what could be a watershed year for housing policy.

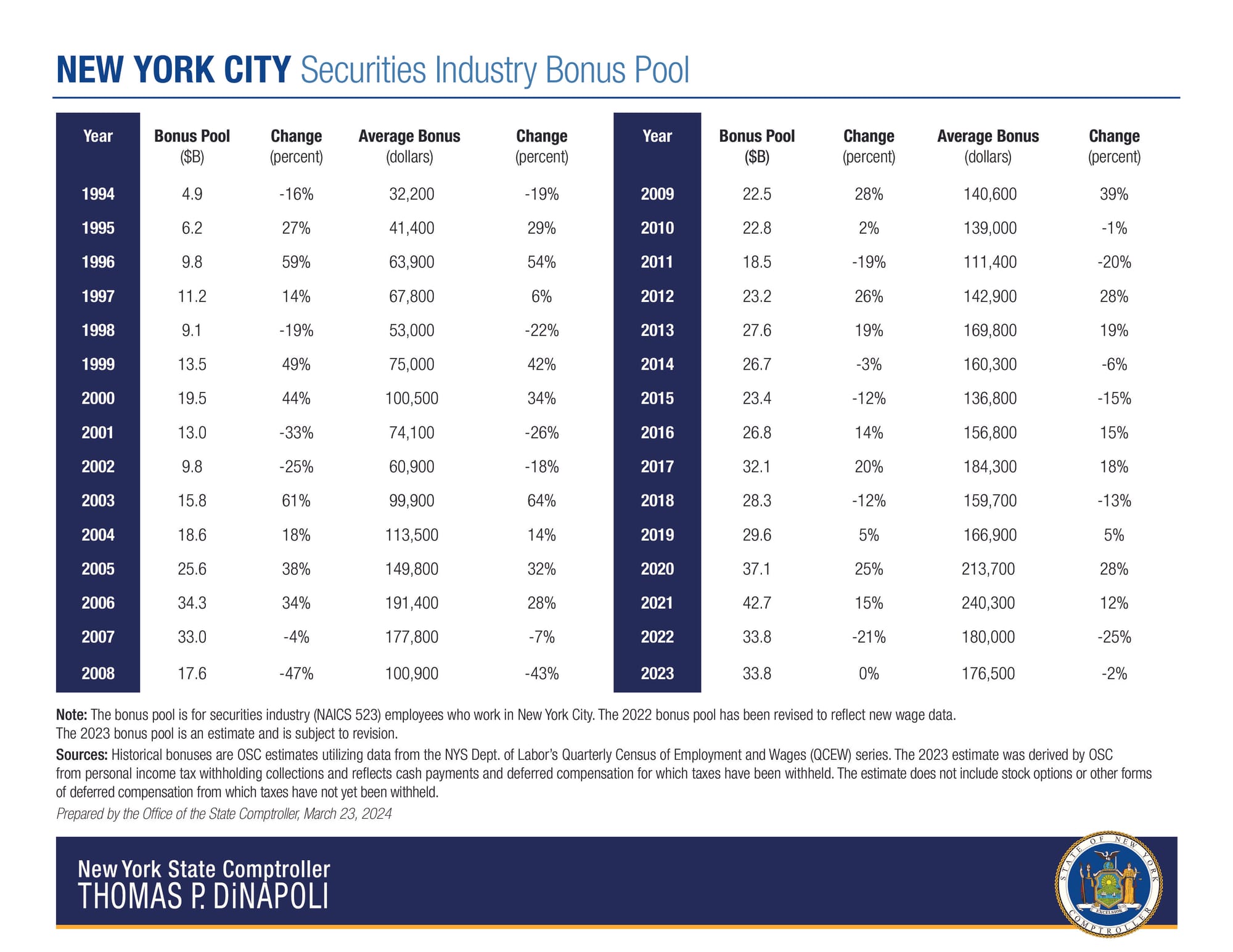

The $33.8-billion bonus pool for 2023, which closely matched the 2022 pool, was well below the 25% growth seen in 2020 ($37.1 billion).

ALBANY—The average annual Wall Street bonus dipped to $176,500 last year, a 2% decline from the previous year’s average of $180,000, according to New York State Comptroller Thomas P. DiNapoli’s annual estimate released on March 19.

Wall Street’s profits were up 1.8% in 2023, but firms have taken a more cautious approach to compensation and more employees have joined the securities industry, which accounts for the slight decline in the average bonus, the report stated.

“Wall Street’s average cash bonuses dipped slightly from last year, with continued market volatility and more people joining the securities workforce,” DiNapoli said. “While these bonuses affect income tax revenues for the state and city, both budgeted for larger declines so the impact on projected revenues should be limited. The securities industry’s continued strength should not overshadow the broader economic picture in New York, where we need all sectors to enjoy full recovery from the pandemic.”

The $33.8-billion bonus pool for 2023, which closely matched the 2022 pool, was well below the 25% growth seen in 2020 ($37.1 billion) and the 15% jump seen in 2021 ($42.7 billion), but slightly over the pre-pandemic high of $32.1 billion.

Wall Street bonuses have a significant impact on tax revenue in the state and city budgets. DiNapoli estimates that the securities industry accounted for approximately $28.8 billion in state tax revenue, or 27.4% of the state’s tax collections, for State Fiscal Year (SFY) 2022-23, and $5.4 billion in city tax revenue, 7% of total tax collections for City Fiscal Year (CFY) 2023.

In 2022, bonuses generated $447 million less in state income tax revenue and $204 million less for the city compared to the prior year. DiNapoli projects the 2023 bonuses in New York City’s securities industry will generate $4 million less in state income tax revenue and $2 million less for the city when compared to the previous year. The governor’s proposed budget assumed bonuses in the broader finance and insurance sector would decrease by 2.7% in SFY 2023-24, while the city’s CFY 2024 financial plan assumed a decrease of 7.8% in securities industry bonuses. These anticipated declines should minimize any significant impacts to their budgets in the short term.

The securities industry also has a significant impact on the city’s employment and overall economy. In 2023, the sector employed about 198,500 people, up from 191,600 the prior year. DiNapoli estimates that one in 11 jobs in the city is either directly or indirectly associated with the securities industry. While the city remains the capital of the U.S. securities industry, its share of the sector’s jobs has been declining over time. Sector employment in 2023 was 1.3% lower than in 2000, which represented the peak for securities industry employment in the city.

As more securities employees are back in the office, there is increased spending in the city. Financial services firms reported 65% of employees were in the office on any given day in September 2023 (post-Labor Day), compared to 58% for all firms in the city, according to the Partnership for New York City’s survey.

Additionally, 42% of securities industry employees ride the subway, a higher rate than the citywide average for workers. DiNapoli estimates Wall Street was responsible for 14% of all economic activity in the city in 2022, and thus the financial sector’s ability to generate revenue and turn profit is critically important to New York.

Receive original business news about real estate and the REALTORS® who serve the lower Hudson Valley, delivered straight to your inbox. No credit card required.