R2M Realty Adds Two New Agents

Now a licensed New York real estate agent with R2M Realty, Inc. Attenborough is dedicated to helping families find the right home…

By William Pattison, Reginald Ross, Michael Steinberg and Austin Iglehart

Editor’s Note: The following article is reprinted with permission from MetLife Investment Management.

2020 was the most challenging year on record for hotel owners, far surpassing the lows reached following the 2008 and 1981 recessions. In order to project how and when hotels will recover, we believe it is worth separating the recession’s purely economic impacts from the “stay home” COVID impact.

Historically, estimating hotel performance has been easier than one might think. Using only hotel construction completions and employment changes, for instance, we were able to model 74% of annual RevPAR growth within a given year, from 1992-2019 The relationship obviously disconnected in 2020 as the pandemic began.

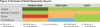

Specifically, RevPAR declined by 47.5% in 2020, but the model suggests only 3.5 percentage points of the decline can be attributed to typical demand factors (i.e. employment declines) and supply coming online. We attribute the remaining 44.0 percentage points to the COVID-related demand impact, driven by social distancing and stay home orders, and we believe this gives us a reasonable starting point from which we can forecast the post-COVID recovery in hotel demand and thus RevPAR.

Hotel Demand in a Post-COVID World

As we noted in a 2019 report, “A New Dawn in Retail,” experiences (versus goods) are capturing an increasing share of personal expenditures, and hotels have benefited from this trend over the past several decades. Even following the introduction and rapid expansion of a major competitor (Airbnb) in the last decade, hotels’ share of personal consumption has steadily increased. We do not believe the pandemic has altered the secular shift toward experienced-based spending.

In addition to consumer preferences favoring experiences over goods, the nature of this downturn suggests that those who are most likely to spend on travel will have the means to do so once vaccines are widely distributed and travel is considered safe. Our base case assumption is that vaccine distribution will allow for herd-immunity to be achieved in the U.S. by mid-summer.

Individuals earning over $70,000 per year have historically been responsible for 75% of hotel spending. For this demographic, the recession effectively ended shortly after it began in April of 2020. Job losses have recovered, and employment has now even surpassed pre-COVID levels. Personal savings has also increased sharply. This is very much different than in prior recessions, such as the Global Financial Crisis, when higher income groups contended with elevated unemployment for several years, and leisure travel was slow to recover. We believe the economic picture alone suggests a surge in leisure travel later in 2021, even before accounting for pent-up demand that surveys suggest has been growing over the last six months. Data from online vacation services support this view, showing a correlation between vaccine distribution and summer 2021 travel bookings. Beyond 2022, we believe the secular trend of experienced based spending growth will continue to boost leisure travel, and leisure hotel demand will remain in excess of pre-COVID levels.

Our outlook for leisure travel is positive, but post-pandemic business travel may be more challenging to forecast. Although we believe the historical relationship between job growth and RevPAR (cited earlier) is a reasonable starting point in the forecast, there are some additional considerations. Hotels that cater to large group/conference travel may experience a delayed recovery given that social distancing advisories may be in-place through 2022. Group hotels face the additional burden of deriving a larger portion of revenues from food & beverage components, unlike limited-service hotels more commonly associated with transient travel. As such, these assets may not fully recover until 2025.

Hotels that support transient business travel may also face challenges in coming years. We estimate that corporate travel budgets will be 25% below pre-COVID levels in 2021, and 15% below in 2022. That said, the slowdown in 2021 may have been front loaded, and we expect a temporary rebound in transient travel as offices reopen during the second half of 2021. Additionally, a mix of industries from entertainment to biomedical engineering have experienced rapid growth during the pandemic, and certain roles in those sectors could benefit from travel, in our view.

Over the medium and longer term, we expect business transient demand to face headwinds from the increased adoption of virtual meetings. Based on a variety of industry surveys conducted pre and-post COVID, we expect a 15% structural decline in transient business demand.

Lastly, international travel is likely to be slower to recover as many countries have less vaccine access than the U.S., making extended flights less safe. Although this could suggest a slower recovery in markets like New York, Miami, Los Angeles, and San Francisco, increases in domestic leisure travel are already helping to offset it. For example, hotels in Miami experienced occupancy rates nearing 80% during the Martin Luther King holiday weekend in January, similar to pre-COVID levels.

A Softer Landing

The COVID pandemic has introduced some long-term structural headwinds for hotels, but we believe it has also offered two self-correcting mechanisms that help offset the risk; namely, a reduced supply pipeline and the rise of digital nomads as a new source of hotel demand.

Leading into the COVID crisis, the hotel sector was contending with an elevated supply pipeline, with U.S. hotel stock projected to increase 13.5% between 2020 and 2025. Today, forecasts show the supply pipeline has moderated, and now stands at 9.2% of current stock. This figure also does not reflect the likelihood of a portion of hotel stock that may go offline or be converted to an alternative use such as multifamily, further constraining supply. New York, for example, has proposed zoning changes for hotels in order to support housing affordability in the metro.

Leading into the COVID crisis, the hotel sector was contending with an elevated supply pipeline, with U.S. hotel stock projected to increase 13.5% between 2020 and 2025. Today, forecasts show the supply pipeline has moderated, and now stands at 9.2% of current stock. This figure also does not reflect the likelihood of a portion of hotel stock that may go offline or be converted to an alternative use such as multifamily, further constraining supply. New York, for example, has proposed zoning changes for hotels in order to support housing affordability in the metro.

In addition to a moderating supply pipeline, COVID-19 has also created a new source of hotel demand in the form of the digital nomad. An acceleration in flexible working arrangements means individuals can work from anywhere and are not consigned to working in their homes. The extended duration of hotel stays during lockdown provides some early evidence of this, and we believe the trend will persist in a post-pandemic world.

Prior to COVID, U.S. employees took on average 17 days off per year and used eight days for travel. The top three reasons for individuals not traveling more during the year all reflected a lack of workplace flexibility. We believe newly formalized remote or flex working policies among tens of millions of office workers could increase the average number of travel days per year, adding to hotel demand.

Capital Market Conditions

Unlike other real estate sectors, and unlike the broader non-real estate investment universe, we believe the hotel sector is experiencing a capital markets and liquidity crunch. In hotel equity markets, we estimate that prices declined between 10% and 60% depending on the asset characteristics.

Part of the reason our price estimate is so wide relates to varying characteristics of hotel assets, with limited-service hotels generally faring better than full-service hotels. Limited-service hotels have historically had lower volatility NOI changes, and we believe this is largely due to the lower average fixed costs limited-service hotels have compared to full-service hotels. Full-service hotels are also more exposed to group travel, which as we outlined has seen the most severe COVID-related demand impact.

A second reason our price decline estimate is so wide relates to the bid-ask spread that persists, and depressed levels of transactions that are occurring. Just $12 billion in hotel properties changed hands in 2020, and nearly half of that occurred in the first quarter (before the COVID recession began). This total is down from an average of $37 billion per year in 2017-2019. Transaction volume has grown during the early months of 2021, but is unlikely to recover to pre-COVID levels in the near-term, in our view. Current owners of hotels are largely unwilling to accept what they view as discounted offers for their properties in hopes of a significant rebound in business once a greater portion of the population is vaccinated and/or herd immunity is achieved.

Lending activity has also slowed materially. Hotel originations across lender types declined by 79% year-over-year in 2020, a more significant decline than retail (-72%) and office (-56%). Although activity has been modestly picking up in 2021, we believe it will also remain well below pre-COVID levels in the near term, similar to equity markets.

In the mortgage investing space, many non-CMBS lenders have been willing to grant payment deferments (but not forgiveness). We believe patience to keep deferring is coming to an end, and we expect subordinate debt and preferred equity opportunities to become more prevalent.

In the CMBS space, we estimate 15% of conduit hotel loans are 90+ days delinquent, or $7.5 billion of principal balance, as of this writing. We believe these borrowers may also contribute to a growing universe of subordinate debt and preferred equity offerings.

Aside from level of distress in the hotel sector, the CMBS universe also reveals that there is simply a lot of debt that will need to be refinanced over the next several years.

About 30% of outstanding hotel loans in CMBS matures in 2021, though some of that $25 billion set to mature could be pushed into 2022, and to a lesser degree 2023, via extension options. This likely mirrors maturities schedules across other lender types. In addition, we have observed that many hotels that are not facing refinance risks have nonetheless been seeking “rescue” operating capital. Traditional financing sources have been requiring higher coupons, and these sources alone may not be sufficient to support the demand for hotel liquidity during the remainder of 2021 and into 2022. As such, we believe the number of attractive opportunities for investors in the hotel debt space could remain strong in coming quarters.

Conclusion

This past year became the most difficult on record for investors in the hotel sector. Market turbulence, though, often presents opportunities to investors who remain in the market. Today, the hotel sector continues to face challenges, but we believe the most difficult period for hotel demand is behind us. In the very short-term, we believe investors who can provide liquidity to the hotel market could be rewarded with outsized returns.

William Pattison is Head of Real Estate Research & Strategy within the risk, research & analytics group; Reginald Ross is an Associate Director in the Risk, Research, and Analytics Division; Michael Steinberg is a member of the real estate research & strategy team within the risk, research & analytics group and Austin Iglehart is an analyst on the real estate research & strategy team within the risk, research & analytics group of MetLife Investment Management.

Receive original business news about real estate and the REALTORS® who serve the lower Hudson Valley, delivered straight to your inbox. No credit card required.