NEW YORK—New York Attorney General Letitia James released a scathing report earlier today on what she termed as a “stark racial gap” in homeownership rates and access to home financing across New York State.

These disparities are a significant contributor to the racial wealth gap and result in higher housing costs for homebuyers of color, making it harder for communities of color to build lasting financial security and overcome decades of systemic discrimination in the housing market, the report stated. According to the 49-page report, the disparities and higher fees cost Black and Latino borrowers more than $200 million over the course of their mortgages.

The Office of the Attorney General’s report found that homeownership in New York is concentrated in white households and neighborhoods. This trend of lower homeownership rates for people of color is present throughout the state. The report noted that the City of Albany has the second-largest gap between white and Black homeownership of any city nationwide, second only to Minneapolis. Across New York, white households are 25% more likely than Asian households to own their home and more than twice as likely as Black or Latino households to own their home.

“Owning a home is an essential part of achieving the American dream and building wealth to pass on to future generations,” said Attorney General James. “Unfortunately, unequal access to affordable credit is still pervasive across our state, reinforcing the legacy of segregation, leading to a disparity in homeownership, and fueling the racial wealth gap. This report makes it clear that our state must do more to provide better resources for homebuyers and strengthen housing laws to help empower more New Yorkers. My office remains committed to fighting housing discrimination in all forms, and I look forward to working with my partners in government to address this problem.”

The report also reveals the significant barriers that borrowers of color face when attempting to purchase a home. Not only are Black and Latino New Yorkers disproportionately underrepresented among mortgage applicants, all applicants of color are denied mortgages at higher rates than white applicants, regardless of credit score, income, size of the loan, and other factors. Even among borrowers with the highest credit scores, non-white mortgage applicants are denied a mortgage at nearly double the rate of white applicants.

Some of the key findings of the report include:

• Lower homeownership rates for people of color were present in every single region in the state.

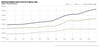

The report showed that white households in New York are more than twice as likely as Black or Latino households to own their home. Among white households, 67% own their homes, compared to only 34% of households of color according to the Census’s American Community Survey (ACS) based on 2020 data. Homeownership rates were particularly low among Black households (32%) and Latino households (27%).

• Black and Latino people are underrepresented among those who apply for purchase mortgages

• Lenders received disproportionately fewer applications for home purchase loans in 2021 from Black and Latino applicants: Statewide, 7.6% of purchase applications were from Black residents and 9.5% were from Latino residents, approximately half of each group’s representation in the overall state population.

• People of color who apply for loans for purchase mortgages were more likely to be denied.

• Applicants of color in New York are denied home purchase mortgages at higher rates than are white applicants.

“This is true even when controlling for credit score, income, size of loan, debt-to-income ratio, loan-to-value ratio, and year of application. When controlling for these factors, the probability of a Black or Asian applicant’s purchase application being rejected in 2021 remained 43% higher than for a white applicant; Latino applicants were 33% more likely to be rejected than a white applicant,” the report stated.

• When borrowers of color are approved for purchase mortgage loans, they are charged more interest, costs, and fees.

The report stated that Black and Latino borrowers received more-expensive loans as compared to white and Asian borrowers. On average, Black and Latino borrowers were charged more than $4,200 more in interest-rate payments over the course of the loans and an additional $900 in other costs and fees. For purchase loans originating between 2018 and 2021, across all loans with terms of 30, 25, 20, 15, or 10 years, Black and Latino borrowers faced an estimated $200 million more in interest and other costs and fees over the course of their loans as compared to white and Asian borrowers.

Asian borrowers were more likely than white borrowers to have higher average costs and fees across loan types.

The report also indicated that there are racial disparities that exist for people of color when refinancing their homes. For example, applicants of color have a 21% greater probability of having their refinancing loan applications denied compared to white applicants with the same application characteristics.

In addition, the report stated that refinancing with historically low interest rates during the height of the COVID-19 pandemic was unequal, with 16,000 fewer applications from neighborhoods of color as compared to white neighborhoods. This resulted in a loss of an estimated $44 million in annualized savings for neighborhoods of color across the state.

The report charged that “A deep legacy of racism and disadvantage has harmed neighborhoods of color, and non-depository lenders have not solved the problem. These disparities exist not only between individual applicants and borrowers of different races, but are also present across neighborhoods: Black and Latino neighborhoods have fewer applications, higher rates of denial, and costlier loans.

New private-sector, non-depository lenders have not solved these challenges. They show similar disparities in rates of applications and denials, as well as costlier fees, the report stated.

“These disparities are not new. They are both persistent and rooted in historic discrimination. Public policy has thus far failed to address these issues; in fact, public policy has at times created or exacerbated them. Moreover, while discrimination by individual lenders explains some of these disparities, the problems reflect systemic failures that will require structural reforms,” the Attorney General’s report stated.

Among some of the housing advocacy organizations that commented on the report’s findings included said Ronald Rosado Abad, CEO of Community Housing Innovations, who said, “It is disheartening to read New York Attorney General Letitia James’ report detailing that hard working, credit worthy, savings-minded Black and Latino New Yorkers remain less likely to own a home, more likely to be denied mortgages, and charged higher interest rates for a loan. Homeownership is the basis for wealth creation and upward mobility. Community Housing Innovations, a major nonprofit leader in the affordable housing and homeownership industry in New York, supports and advocates for increased access to homeownership financing for all New Yorkers.”

“We thank Attorney General James and her team for doing this work and sharing it with us,” said Tanya Dwyer, Legal Services of the Hudson Valley. “The numbers in this report reflect the disparities and effects of systemic discrimination that we see in our work with clients. As a Homeowner Protection Program Network member, we will continue to fight alongside the Attorney General’s Office to protect homeowners from such discrimination.”

The report identified a number of state-level policy solutions that could help close the racial homeownership gap, such as subsidizing down payments and interest rates for first-generation home buyers, who are disproportionately people of color, to make it easier for families who have never bought a home to get credit.

Other recommendations include increasing state funding to nonprofit financial institutions that can better support communities of color underserved by traditional financial institutions and passing the New York Public Banking Act to create a regulatory framework for cities, towns, and regions to establish public banks. These institutions would help expand access to affordable financial services in underserved communities.

The report also calls for increasing resources for government agencies’ fair lending investigations and strengthening New York’s Human Rights Law to expressly prohibit lending practices that have a disparate impact on communities of color, as well as exploring options for state-provided banking services at places like libraries and post offices to help reduce the population of New Yorkers who lack adequate access to traditional banking services.