Editor’s Note: The push by the real estate industry to bring transparency to the co-op transaction process, particularly by the Hudson Gateway Association of Realtors and the New York State Association of Realtors, was the subject of a recent Realtor Magazine article.

Realtors have had some successes in the fight for transparency.

When a New York State Association of Realtors member represented an openly gay city council member looking to purchase a co-op, the client brought an all-cash offer and retirement funds in excess of $150,000, But the co-op board rejected his application, giving no rationale. The decision left both the member and his client scratching their heads. Was there hidden bias because the buyer was gay?

The Secret Life of Co-ops

Discrimination is difficult to discern in any failed bid for a property, but when a co-op board is involved, the circumstances around a rejection are downright murky.

Cooperative housing, or co-ops, represent a different type of shared ownership arrangement than the more common condominium ownership, where buyers purchase the units they live in and an ownership interest in the building’s common areas. People living in a co-op own shares in the entire complex. Each owner receives a proprietary lease on a specific apartment and is obligated to pay a monthly maintenance charge that represents the proportionate share of operating expenses and debt service on the underlying mortgage, which is paid by the corporation. While the majority of co-ops are in New York, Washington, D.C., and California, they exist in other states, including Arizona, Colorado, Illinois, Indiana, Kansas, Massachusetts, Michigan, Minnesota, Missouri, Oregon, Pennsylvania, Texas, Wisconsin, Georgia and Florida.

Co-ops’ self-governing structure gives the owners the freedom to develop and maintain their environment and select who gains entry and who does not. While some co-op boards provide a reason for rejecting an applicant, many do not, nor are they required to in many places. Co-op boards are ostensibly looking to see who is going to be a “good neighbor,” which can be a pretext for bias or discrimination. In some pockets, a determined group of Realtors, members of the National Association of Realtors, is making headway toward greater transparency.

Incremental Successes

For close to two decades, Realtors have been on the front lines pushing for reforms that ensure fairness and transparency in co-op housing transactions.

“Buyers of co-ops pay an application fee, mortgage application fee and other costs that are not refundable if the buyer is rejected,” says Barry Kramer, SRES, principal broker-owner of Better Homes & Gardens Real Estate in Scarsdale. Kramer has been a key player in driving for greater transparency.

Reform proponents say the status quo—specifically, the length and scope of co-op applications, the review period, and the approval process—makes discrimination both easier to perpetrate and difficult to identify and prevent. They are fighting for uniform guidelines, as well as a requirement that co-op boards offer a reason for rejecting an applicant, to minimize the opportunity for discrimination.

In the greater New York City area, “the high cost of real estate makes co-ops a great entry into homeownership,” says Marlo Paventi, senior director of public policy and government affairs at the Long Island Board of Realtors. In addition to first-time buyers, seniors looking to downsize often explore co-op ownership, says Kramer, who served as 2018 president of the Hudson Gateway Association of Realtors, which spans Manhattan, The Bronx, and Westchester (as well as Rockland, Orange and Putnam counties).

Mike Kelly, director of government affairs for NYSAR, says that after Newsday published “Long Island Divided” in 2019—a report detailing the results of fair housing testing on Long Island—he was certain there would be movement both statewide and in New York City on bills aimed at reforming the co-op sales and management process. And there have been efforts, he says. The New York City Council Bill Int. 915 would require co-ops to provide prospective purchasers with a written statement identifying each reason for denying the application within five days after the decision is made. A state bill, A02685, would amend New York’s Civil Rights Law §19-A to require cooperative housing corporations to provide a prospective purchaser with a written statement of reasons for a rejection. Despite Realtors’ efforts, these and other similar legislation have stalled.

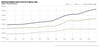

Undeterred by the lack of movement, Realtors have successfully advocated for co-op transparency bills in five New York counties—Nassau, Suffolk, Westchester, Rockland and Dutchess. The first of these victories came in 2009, in Suffolk County, when the county passed a Realtor-supported bill requiring co-op boards to make a decision, provide the purchaser with written notice of the decision, and, in the case of a denial, provide notice of the grounds for the rejection within 45 days after the receipt of an application.

With the support of Realtors, Westchester County passed legislation in 2018 and 2021 and Rockland County passed legislation in 2018 and 2022. Both counties now require co-op boards to disclose the minimum financial requirements to applicants before they apply. Realtors also advocated for the passage of legislation adopted in Nassau County in 2019 that imposes a financial penalty on co-op boards that don’t respond to applicants within 45 days. A bill passed in Dutchess County in 2020 requires co-ops to maintain records for seven years of every submitted application, including written notices of the grounds for rejection; co-op boards must produce these records to the Dutchess County Deputy Commissioner for Housing upon request. All but Nassau County require the co-op board to state a reason when rejecting an applicant.

Turning the Tide of History

Absent such legislation, the co-op approval process remains as opaque today as it was when co-ops were first established.

In a 2021 article for The Real Deal, journalists E.B. Solomont and Sylvia Varnham O’Regan wrote about the early pervasiveness of discrimination in New York co-ops. Co-ops gained significant traction in New York City in the early 1900s, they said, when developers, capitalizing on the climate of the day, promoted them as a way to live with others who were both financially stable and “acceptable.” Many of the earliest co-ops had explicit exclusions based on such characteristics as race, ethnic origin and religion. While blatant discrimination is no longer prevalent, the secretive screening process remains firmly intact.

“Too many co-op boards thrive in secrecy and conceal their reasons for denying housing to individuals and families,” says Britny McKenzie, policy manager at the Fair Housing Justice Center in Queens, N.Y. “The passage of a [state] co-op disclosure law will create greater transparency for prospective applicants and deter discrimination.”

In a recent survey conducted by NAR’s Research Group, Realtors were asked about their experiences with co-op transactions. The survey uncovered several questionable decisions by co-op board. One member recounted an experience working with a client who had been injured in an accident and used a wheelchair. The client had received a substantial settlement from the accident, but the co-op board rejected her application, despite her offer to escrow 10. years of assessments. Another Realtor said she represented a single mother of two with stellar financial qualifications who was rejected by a co-op board. Both said they felt discrimination played a role.

Co-op boards can require potential buyers to submit to an extensive interview and make substantial financial disclosures, says Liz English, AHWD, SFR, a West Islip broker. Yet, co-op board members typically aren’t required to take fair housing courses, there’s no mandated protocol to facilitate communication between the co-op board and prospective buyers, and there’s no requirement that obligates co-op board members to disclose the minimum financial threshold buyers must satisfy to be eligible to live in these properties.

English, a member of NAR’s Fair Housing Policy Committee, says Realtors must and will continue to push for fairness and transparency in co-op transactions. “If one person is discriminated against in attempting to purchase a co-op,” she says, “it’s one too many.”

Reprinted from REALTOR® Magazine by permission of the National Association of REALTORS®. Copyright 2023. All rights reserved.