WHITE PLAINS—As governments across the globe deal with the spread of the Novel Coronavirus—or COVID-19—the crisis hit home earlier this week when it was learned that an attorney from New Rochelle tested positive for the virus.

On March 4, Gov. Andrew Cuomo confirmed reports that in addition to the 50-year-old attorney, three members of his family and a neighbor have also tested positive for Novel Coronavirus.

While the federal and state governments continue to scramble to deal with the crisis, many real estate professionals are expressing fears that COVID-19 could possibly cause national and international markets to suffer at least in the short term.

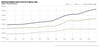

The Federal Reserve on March 3 in a surprise move took action in direct response to the Coronavirus’ potential impact on the U.S. economy.

While noting that the fundamentals of the U.S. economy remain strong, the evolving risks to economic activity from the Coronavirus prompted the Federal Open Market Committee to lower the target range for the federal funds rate by 1/2 percentage point to a range of 1.0% to 1.25%.

Commercial brokerage firm CBRE in its “US Marketflash” report released on March 4, stated that the markets are pricing an additional 50 basis points in cuts before the end of the year by the Federal Reserve. The firm noted in its briefing that Fed Chairman Jerome Powell cited challenges for the travel industry and industries with global supply chains but noted that the extent of the impact remains highly uncertain.

“Monetary policy alone will not be enough to mute negative economic impacts from COVID-19. Additional policy responses—particularly from fiscal authorities—will be needed. To that end, the G7 finance ministers affirmed their ‘commitment to use all appropriate policy tools to achieve strong, sustainable growth and safeguard against downside risks.’ While G7 leaders did not announce any definitive plan of action, they have additional capacity to mitigate risks to the economy posed by the spread of COVID-19. At the outside, the lifting of trade tariffs is a possibility.”

Noting that commercial real estate fundamentals at the onset of the crisis were in an extremely strong position and labor markets very tight, CBRE expects companies will likely maintain employment through the crisis.

“Nevertheless, property markets will reflect the broader economy, which is expected to see a short-term slowdown. Should the spread of the virus prove to be only seasonal, impacts will lessen as the weather warms, allowing for stronger growth in the second half of the year,” CBRE states.

The firm also expects capital market transactions to slow at least in the short term, but that capital values will be resilient. “Additionally, there may be some impact on leasing, as decisions on new space are deferred until later in the year. With the 10-year Treasury trading at historically low levels—below 1% for the first time—low interest rates will be a positive factor for property markets,” CBRE states.

In terms of its views on COVID-19’s impact on individual markets, CBRE predicts:

“Hotels: There has been a reduction in business and leisure travel, both globally and domestically. Using the SARS pandemic of 2003 as an example, the hotel industry could be severely impacted for up to six months.

Retail: Near-term impacts will occur due to reductions in travel, particularly for food and beverage establishments, entertainment venues and fashion retailers. Omnichannel retailers could see some near-term upside as consumers avoid stores and shopping malls, but consumer sentiment may weigh on the sector over a longer period.

Industrial: Manufacturing and distribution facilities may be impacted by lack of inventory as supply chains are disrupted. Broader economic impacts could further weigh on the industrial sector as reductions in both supply and demand ripple across the economy. Conversely, if the virus prompts more people to shop for goods and food online, this would bolster demand for last-mile distribution space.

Office and Multifamily: Impacts on fundamentals in these sectors likely will be secondary and more closely associated with overall economic activity.

Construction: Building material supply chains are being affected with significant backlogs at Chinese ports. Imports from other parts of Asia are also being impacted. Multifamily construction likely will feel the most acute effects due to the importance of Asian-sourced materials for residential construction.’

CBRE predicts that downside risks have increased as COVID-19 spreads worldwide and that market volatility is a threat to consumer confidence, which has been critical to the economic growth the U.S. has experienced in the past year

“It is unlikely that confidence will return until the spread of COVID-19 is contained, which is why the Fed acted urgently today,” CBRE states. “Furthermore, fiscal and monetary policymakers retain significant capacity to act forcefully in response to additional downside risks posed by this evolving threat to economic activity. In the long term, pent-up demand and the lagged effects of monetary policy should provide significant tailwinds to the global economy.”