West of Hudson Transit Study Launched

The West of Hudson Transit Study will center on service improvements to bus networks, including local routes, regional commuter bus service, and micro-transit.

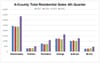

WHITE PLAINS—The see-saw year, aka 2020, ended on an astonishingly high note for real estate practitioners in the Lower Hudson Valley, according to the 2020 Fourth Quarter Residential Real Estate Sales Report for Westchester, Putnam, Rockland, Orange, Sullivan, and Bronx counties released on Jan. 5 by OneKey MLS.

After experiencing strong first quarter sales, agents looked forward to and anticipated more of the same for the second quarter. What occurred instead was a decimated market as a result of COVID-19, and the virtual shut down of real estate activity. Creativity and technology, as well as a desire by city dwellers to escape their close environs, resulted in historically high single-family residential sales in the third quarter which, as it turns out, was only a preview of what was to occur in the fourth quarter.

Every county in the region, with the exception of the Bronx, which falls in the city category, experienced year-over-year increases in residential home sales. All regions, the Bronx included, also saw increases in median sales prices. While year-over-year increases were significant, fourth quarter increases were nothing short of dramatic.

Westchester, which comprises the largest market in the region, had a year-over-year increase in single-family residential sales of 14% or 6,657 units as compared to 5,839 for 2019; one third of those sales occurring in the fourth quarter of 2020. There were 2,232 single-family sales in the fourth quarter as compared to 1,415 sales in the fourth quarter of 2019, a 57% increase. Year-over-year, the median price of a single-family home in Westchester increased more than 12% to $735,000, compared to $655,000 for 2019.

Increases were no less impressive in other counties. Putnam County, one of the smaller markets in the region, had an annual increase in single-family sales of 20%, going from 1,050 units in 2019 to 1,261 units in 2020 with a median price increase of 6% or $380,000, as compared to $358,000 in 2019. Single-family sales in Rockland County increased 14.7% for the year, with 36% of sales taking place in the fourth quarter. Unit sales for the year were 2,327, as compared to 2,028 in 2019. The median sales price of $500,000 was an almost 10% increase over the 2019 median of $455,000.

Year-over-year, single-family sales in Orange County increased 8.5% to 3,984 units from 3,673 units in 2019, the highest number of single-family sales ever recorded for one year in Orange. Again, 36% of those sales took place in the fourth quarter. The median sales price in Orange increased by 19% to $330,000 from $277,250 in 2019, finally surpassing a high of $322,500 in 2007. Sullivan County, the northernmost in the region, had the highest percentage increase in sales for the year. Single-family sales of 1,232 units surpassed 2019’s number of 979 by 25.8%, with a median price increase of 36.8% to $195,000 from $142,500 in 2019.

Condominium unit sales were mixed, but prices increased in all markets both for the fourth quarter and year-over-year. Westchester County condo sales were down by 6.8% for the year, but showed surprising strength in the fourth quarter, increasing by 48% with an annual price increase of 5% to $404,500 from $385,000 in 2019. Condo sales were strong in Putnam, up 37.3% to 173 units from 126 units in 2019. Rockland County condo sales increased year-over-year by 7%, while prices went from $247,250 in 2019 to $265,000 in 2020. Orange County condo sales dropped almost 11% for the year, but showed some strength in the fourth quarter increasing by 10% to 151 units over the same period in 2019. Condo sales were also weak in Bronx County, dropping 14.7% in 2020 (157 units compared to 184 units in 2019).

Westchester and Bronx counties continued to see their co-op markets slide with a drop of 16.7% in sales in Westchester (1,559 units sold in 2020 as compared to 1,871 units in 2019) and a drop of 27% in the Bronx (391 units as compared to 537 units sold in 2019). Co-op prices rose in both counties. Multi-family (2-4 units) sales were down in all areas (with no change in Sullivan), but prices continued to increase in that category as well.

In general, the days a property stayed on the market (DOM) were down in all market areas and properties sold very close to, and in many instances above, list price—all indicative of a strong market.

The real estate market has been an anomaly in a difficult economy and future predictions for the market are difficult at best. Inventory is at an all-time low, which may negatively impact sales and put upward pressure on prices which, in turn, affect affordability. This is somewhat offset by the low interest rate environment. A higher than usual unemployment rate for the area remains a concern, but commercial activity in the lower Hudson Valley remains strong and should bode well for the residential sector. A high level of pending sales is an indication that in the near-term, sales will remain strong.

Sales data was provided by OneKey™ MLS, one of the largest Realtor subscriber-based MLS’s in the country, dedicated to servicing more than 41,000 real estate professionals that serve Manhattan, Westchester, Putnam, Rockland, Orange, Sullivan, Nassau, Suffolk, Queens, Brooklyn, and the Bronx. OneKey™ MLS was formed in 2018, following the merger of the Hudson Gateway Multiple Listing Service and the Multiple Listing Service of Long Island.

Receive original business news about real estate and the REALTORS® who serve the lower Hudson Valley, delivered straight to your inbox. No credit card required.