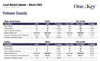

WHITE PLAINS—Across the entire Hudson Gateway Association of Realtors region, demand for all types of housing remains high. Single-family home sales in March continued to decline, with the Bronx experiencing the largest decrease of almost 30%, followed closely by Orange County with a 28.8% drop from this time last year. All other areas experienced double-digit declines in single-family home sales, with the exception of Sullivan County, which saw an 8.3% decrease.

Sales of condos and co-ops in most of the region also saw sharp drop-offs, with the exception of Rockland County, where condo sales rose by 8.6%.

On the flip side, March single-family home prices escalated in all areas, with the highest rate in Putnam County—a 19% hike—followed by Orange County with a 13% increase. Pending sales for all property types were down in most of the Hudson Valley, except for a slight uptick in Orange County. The Bronx, however, showed an impressive 30.3% increase in pending sales.

Today’s report by the Hudson Gateway Association of Realtors, based on data supplied by OneKey MLS, also indicates inventory levels declined among all property types in all regions. March inventory in the Bronx saw the highest falloff with almost 44% fewer single-family homes and 28% fewer co-ops. Orange County’s single-family inventory dropped by almost 40%, and Westchester County, by 31.3%.

“The Hudson Valley housing market continues to experience strong demand coupled with very low inventory, as interest rates are likely keeping potential sellers and buyers on the fence,” said HGAR CEO Lynda Fernandez. “However, pending sales of single-family homes in the Bronx in March and throughout our market area earlier in the year are an indication of increasing future sales in the suburban New York City market.”

“The spring market is typically a more active time for both sellers and buyers, so we expect to see more sales activity in the coming months,” HGAR President Carmen Bauman added.

Bronx County

In the Bronx, March single-family home sales plunged by 29.3%, while prices rose 6.8% to a median sales price of $625,000 from 2023. Condo sales declined by 11.1%, with the median condo sales price also declining more than 27% to $247,500. In 2023, the median condo sales price was $340,000. Co-op sales fell 28.6% and the median sales price declined by 2.4%, bringing the new median to $205,000 from $210,000 at this time last year.

New listings for single-family homes dropped by 31.5%, while new listings for condos decreased by 39%. Co-op new listings also fell by 11%. Overall inventory for all three housing types was down significantly, with condo sales faring the worst with a 45.1% decline. There were almost 44% fewer single-family homes on the market and nearly 22% fewer co-ops. Ironically, pending sales for all property types are up by 30.3%.

Westchester County

Co-op sales in Westchester County experienced the largest decline at 28.4%, followed by single-family homes at 14.3%, and condos, at 12.8%. Sales prices for all three property types rose, with condos seeing the highest jump at 9.4% to a median of $499,500. Single-family home sales rose by 4.2% to a $758,000 median and co-ops, 4.1% with a median of $202,000.

New condo listings were up by just 4%, but co-op and single-family home listings fell by 18.3% and 14.9%, respectively. Inventory was down in all three sectors, with the largest drop in co-ops at 41.4%, followed by single-family homes at 31.3% and condos at 16.8%. Westchester’s overall pending sales were down by 2.3%.

Putnam County

Single-family home sales in Putnam County decreased by 16.4% over March 2023, while the median sales price saw a 19% hike to $547,450 from $460,000. Condo sales remained the same, but the median price increased 9.5% to $353,000. There were no co-op sales reported.

New listings for single-family homes declined by close to 10%, while condo listings dropped by over 18%. Inventory for both property types decreased by 38.5% for condos, and 24.2% for single-family homes. Putnam County’s pending home sales were also down by 6.5%

Rockland County

Rockland County saw an uptick in condo sales at 8.6%, but March sales of co-ops and single-family homes dropped 60% and 15.3%, respectively. Co-op sales represented the largest increase by more than 17% to $158,500.

The single-family home median sales price increased 9.3% to $699,500, and condos by 4.7% to $354,000. All three property types saw new listings rise, with co-ops receiving the largest hike at 37.5%. Both condos and single-family home listings increased by more than 5%.

Meanwhile, inventory declined in all three areas, with co-ops seeing the largest decrease of over 46%, followed by condos at 27.5% and single-family homes at 18.2%. Rockland’s pending sales were also down, by just over 3%.

Orange County

In Orange County, sales of both single-family homes and condos tumbled by over 28%. Single-family home prices jumped 13.2% to a median of $427,500 from $377,500 at this time in 2023. Condo prices also increased by 5.5% to $279,500. There were no reported co-op sales this time, but the median price increased almost 50% to $147,750 from just $99,250 in 2023.

Inventory for single-family homes fell by almost 40%, and 28.8% for condos. New listings for single-family homes dropped 25.7%, but there were 25% more condos for sale than this time last year. Pending sales for all property types were up by 4.4%

Sullivan County

Sullivan County, the most affordable area of our region, is still seeing prices rise, with a March median of $290,000 for a single-family home – a 6.4% hike over the same time period last year. Sales fell by 8.3% and new listings declined by just 2.2%. The inventory change was less than 1% from last year. No condo or co-op sales were reported. Sullivan’s pending sales were down 15.7% from March of 2023.

(NOTE: Links to ALL regional reports are available at Market Data (hgar.com). Scroll down to 2024 Market Stats).

The Hudson Gateway Association of Realtors is a not-for-profit trade association consisting of over 13,000 real estate professionals doing business in Manhattan, the Bronx, Westchester, Putnam, Rockland, and Orange counties. It is the second largest Realtor Association in New York and one of the largest in the country.