HGAR and NYSAR Celebrate Legislative Wins, Prepare for 2026 Advocacy Push

With the full legislature and governor facing re-election in 2026, HGAR and NYSAR are already preparing for what could be a watershed year for housing policy.

WHITE PLAINS—The negative trifecta of high inflation and mortgage interest rates and low inventory continues to put a significant dent in home buying sales volume in the New York City/Lower Hudson Valley market. Single-family home prices values continued to rise in the first three months of this year in some markets, but indications are that regionwide, single-family home sales values may have reached their cyclical highs.

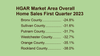

Overall home sales in the region fell by as low as slightly below 25% (Bronx County) to as high as 38% in Rockland County in the first quarter of 2023 as compared to a year earlier. The rest of the region posted double-digit percentage sales volume declines in total residential sales, which include single-family homes, condominiums, co-operatives and 2-4 family multi-family homes. Westchester County had a decrease in residential sales of 32.7%, Putnam County saw a decrease of 31.7%, Orange County’s sales dropped 35.1% and Sullivan County’s sales were down 31.6%. Bronx County saw the smallest decrease in first quarter residential sales, at 24.8%.

Regionwide, single-family home sales fell sharply in all markets. Westchester County saw a 33% decline in single-family sales in the first quarter 2023 as compared to 12 months earlier; Putnam County’s single-family sales dropped 29.3% in the first quarter; Rockland County’s single-family market sales volume declined by 35.3%; Orange County’s single-family sales volume fell 38.2%, while Sullivan County’s single-family sales were 30.2% lower and Bronx County experienced a decline of 25.1% in single-family sales in the first quarter.

Single-family median sales prices continued to rise in the first quarter in Westchester County (4.3% increase to $760,000), Rockland County (4.2% increase to $625,000) and Orange County (5.2% increase to $394,500). Putnam County saw a 5.3% decrease in the median sale price to $450,000, Sullivan County saw a 5% decrease to $254,500, and Bronx County saw a 2.5% decrease in the first quarter of 2023 to $585,000.

Editor’s Note: See the full “2023 First Quarter Real Estate Sales Report Westchester, Putnam, Rockland, Orange, Sullivan, and Bronx Counties, New York” released by the Hudson Gateway Association of Realtors on April 11.

Looking Ahead

Meanwhile, falling mortgage rates create opportunities for many buyers. On April 13, NAR Chief Economist Lawrence Yun noted that the average rate on a 30-year fixed mortgage fell to 6.27% from 6.28% the previous week. “With inflation moving closer to the Fed’s 2% target, mortgage rates are expected to decrease further in the coming months, likely below 6% by year’s end,” Yun said.

This should improve conditions somewhat as Yun related that if rates drop to 6%, “3.1 million more households will once again be able to afford to buy the median-priced home compared to the beginning of the year. And, one in three of these households are younger than 40. Last year, one in five mortgage purchase originations had a rate higher than 6%.”

It should be noted that NAR’s Yun has previously stated that the housing market is in recession and more analysts are predicting an economic downturn or recession later this year. Area Realtors appear pragmatic that the market’s recovery will hinge greatly on a significant increase in the number of new home listings.

HGAR President Tony D’Anzica noted that regionally overall sales volume dramatically declined by between 25% to 39%. “The demand for homes has been reduced as rising interest rates make the cost of borrowing more expensive and the cost of owning a home less affordable. Interest rates, which are at a 15-year high and still higher than they were one year ago, are also contributing to lower inventory by discouraging sellers from listing their homes for sale since staying put with an existing mortgage is less costly than moving and re-purchasing at a much higher interest rate,” he said.

D’Anzica, who is Broker/Owner of Dynamax Realty NYC in New York City, added, “While interest rates are starting to trend downward, more economists are predicting a recession in 2023. Jobless claims have been trending up all year, suggesting that uncertainty in the labor market may further discourage buyers from entering the housing market. With the war in Ukraine, an uptick in trade tensions, recent bank failures, and rising national debt, there are few market indicators that suggest an improvement in the housing market in 2023.”

In the brokerage firm’s recently released first-quarter housing report, Liz Nunan, Houlihan Lawrence, President and CEO of Houlihan Lawrence, noted that in addition to high interest rates and low inventory, buyers may be hesitant to enter the market due to the troubles of late in the banking sector. “The inventory quandary, however, has continued to drive a predominantly sellers’ market forward. Compared to other parts of the country, the marketplace north of New York City remains strong,” she added.

Anthony Cutugno, Senior Vice President, Private Brokerage for Houlihan Lawrence, stressed that despite market headwinds, there are buyers in the luxury market. “Persistent supply chain issues have increased demand for move-in condition, and aptly priced, updated luxury offerings are often rewarded with multiple offers at the lower end of the luxury market,” he said. “Conversely, ambitiously priced, poorly presented listings are overlooked. Concerns of overpaying are on every buyer’s radar as the fear of a longer, deeper recession looms on the horizon as a result of the banking crisis.”

Joseph Rand, Managing Partner and Chief Creative Officer of Howard Hanna | Rand Realty, stated that the brokerage firm predicted last fall that home sales this year would fall to levels last seen in the middle of the 2010s when the housing market was recovering from the 2008-2009 Financial Crisis.

“We believe that prediction is playing out, with first quarter sales throughout the region falling to the levels we last saw in 2013-15. That might seem a little alarming, but we would caution that we all considered those types of closing levels to be relatively strong at the time. It’s not as if we’re back to the sales totals of 2009, which were about 50% of what they are right now. This isn’t a return to the Great Recession,” Rand stressed.

In fact, he predicts that home sales volume and prices will stabilize near 2022 levels for the remainder of the year. Rand stated that most markets have probably seen their high-water marks for home sale prices.

In terms of any improvement in for-sale inventory, he noted that basic economics calls for that when prices go up, supply will rise as sellers see an opportunity to take advantage of high prices. However, he cautioned, “But one concern we have is that too many homeowners are locked into their current homes by “golden handcuffs”—a ridiculously low interest rate on their mortgage, either from when they bought the home or from refinancing when rates were down around 3%. Even if those owners wanted to move, they might not be able to afford the higher payment they’d have to make at today’s higher rates. So, they might not be going to put their homes on the market, even if they want to take advantage of higher prices.”

Receive original business news about real estate and the REALTORS® who serve the lower Hudson Valley, delivered straight to your inbox. No credit card required.