By Mike Fratantoni and Joel Kan

The extraordinary impact from COVID‐19 social distancing measures and business closings is impacting the economy and job market in unprecedented ways. While April economic data has been uniformly awful, more recent data on purchase applications indicate significant pent up demand for housing. Housing demand is strengthening as more states ease restrictions on activity and people get back to work. The multi‐trillion-dollar question is whether April has marked the worst point in this crisis, and perhaps the positive signals from the home purchase market reflect a recovering economy, although we certainly expect the job market and broader economy to bounce back more slowly than purchase applications have.

April was the first full month of the impact and resulted in a record‐loss of 20.5 million jobs. Essentially all sectors lost jobs over the month. Leisure and hospitality, the sector perhaps most impacted by closings and restricted operations, saw a 7.6-million job decrease; retail trade suffered 2 million in job losses. The construction sector lost 975,000 jobs—close to the 2009 annual total—which is a blow to the housing recovery and might impact future housing supply. We expect the unemployment rate will peak in the next quarter but start to decline by the end of 2020, before falling back to more normal levels by 2022.

Perhaps some silver lining in the April employment reports was that around 18 million workers reported being on temporary furlough, and if those unemployed workers are called back to their jobs when the crisis abates, that will support our expectations of a sharp recovery. In the meantime, however, the unemployment rate leapt to 14.7%—the largest monthly jump and the highest rate since the survey’s beginning in 1948. There was also a record fall in the labor force participation rate to the lowest since 1973, as workers dropped out of the workforce and stopped looking for work.

The economy shrank almost 5% in the first quarter and we expect a much sharper drop in growth in Q2 2020, as most of the country was in lockdown for the full month of April. Consumer spending plummeted by 7.6%, including severe weakness in spending on durable goods and also on a vast array of services impacted by social distancing and business closures.

The Federal Reserve has pulled out all the stops to help the economy and financial markets weather the current pandemic. In their statement following the April FOMC meeting, they made clear that supports would remain in place until the economy regains full employment and inflation trends return to normal. Specifically, for the mortgage industry, while they did not specify a pace for agency MBS and CMBS purchases, they did highlight that, “the Federal Reserve will continue to purchase Treasury securities and agency residential and commercial mortgage‐backed securities in the amounts needed to support smooth market functioning.” It is clear they want their actions to result in lower rates for mortgage borrowers and recognize that this can only happen in the context of orderly markets. We expect that they will continue to modulate their purchases, so long as markets remain stable.

Given the speed and magnitude to which the economy and job market have been disrupted, one would expect the impact of this rapid deterioration to be matched by rapidly increasing rates of loans in forbearance. Over 8% of loans serviced are in forbearance, with over 6% of GSE loans and 11% of Ginnie Mae loans in forbearance, based on the most recent data from MBA’s forbearance survey. While the pace of forbearance requests slowed in the second week of May, the share of loans in forbearance continued to increase. However, FHA and VA borrowers are more likely to be employed in the sectors hardest hit in this crisis, which is why more than 11% of Ginnie Mae loans are currently in forbearance. In recent weeks, the pace of increase in the forbearance share has flattened.

In terms of mortgage performance, results from our National Delinquency Survey revealed that delinquency rates picked up in the first quarter of 2020, driven by 30‐day delinquencies. The overall delinquency rate jumped by 59 basis points—which is reminiscent of the hurricane‐related, 64‐basispoint increase seen in the third quarter of 2017, with much of this tied to the increase in early‐stage delinquencies for all loan types. For example, the 30‐day FHA delinquency rate rose by 113 basis points, the second largest increase in the history of the survey, and the 30‐day VA delinquency rate rose by 78 basis points – the highest quarterly increase. The five states with the largest increases in their 30‐day delinquency rates were: New York (29 basis points), Alaska (24 basis points), Florida (23 basis points), Louisiana (22 basis points), and New Jersey (20 basis points). New York, New Jersey, and Louisiana have been noted as states hit particularly hard by the impact of COVID‐19.

Related to the overall lending environment and the risk of forbearance and even delinquency, credit availability fell in April for the second consecutive month. The overall index fell to its lowest level since December 2014, and the sub‐indexes pointed to tightened credit supply for all loan types. The decline was largely driven by lenders dropping many low credit score and high‐LTV programs, as well as further reduction in jumbo and non‐QM products.

In other areas of the housing market, new home purchase applications severely weakened in April, which coincided with the peak of the social distancing efforts and restrictions on non‐essential activities to help slow the spread of COVID‐19. March through May are the prime home buying months every year, but this year activity fell 25% from March and decreased 12% from a year ago. We estimated that new home sales dropped to an annualized pace of 533,000 units—the slowest since December 2016. This decline was in line with data from our Weekly Applications Survey, which indicated a pullback in March and most of April. We do believe that unrealized, pent‐up demand is being released as states start to reopen and expect that heading into the summer, more prospective homebuyers will gradually return to the market. Similarly, Census reported that housing starts in April declined 30% to a seasonally adjusted annualized pace of 891,000 units. Both single‐family and multifamily starts dropped over the month due to the impacts from COVID‐19‐related social distancing efforts and declining construction activity. This was the lowest level of overall housing construction since 2013, and permits for new construction were also down significantly over the month.

While our forecast is for a rapid rebound in housing activity later in the year as homebuyer traffic returns, housing supply remains very tight. This drop in starts, combined with the April employment report showing almost 1 million construction job losses—may potentially slow the rebound in new construction that will be needed to completely revive the housing market.

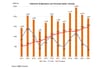

Record‐low mortgages rates are sustaining the refinance wave, helping homeowners lower their mortgage payments and save money during these challenging times. We expect mortgage rates to average 3.4% for 2020 and be slightly higher in 2021 at 3.5% and given that the pace of refinance applications is still more than double last year’s pace, we anticipate that refinance originations will grow by more than 30% in 2020 relative to 2019, reaching $1.2 trillion. Furthermore, the increase in purchase applications in the last four weeks is a sign that housing demand is recovering as more states work toward reopening. All of the top 10 states in our Weekly Applications Survey have started to show week-over-week growth, with about half of those states showing year-over-year increases once again.

Purchase volume is expected to be down slightly for the year when compared to 2019, as the economic and job market weakness through April resulted in a drop in demand for purchase mortgages during a period where housing activity is typically boosted by spring home buying activity. We expect a little over $1.2 trillion in purchase originations, a slight decrease from $1.3 trillion in 2019.

Michael Fratantoni is Chief Economist, Senior Vice President, Research & Technology and Joel Kan is Associate Vice President, Industry Surveys and Forecasts for the Mortgage Bankers Association.