New York City Housing Market at a Critical Crossroads: Affordability, Evictions & Fiscal Policy Fuel Uncertainty

For real estate professionals, understanding the human and economic drivers behind eviction filings is critical.

As the spring selling season approaches, the region’s home sales sector is bolstered by a noticeable increase in pending sales throughout the region.

WHITE PLAINS—January home sales continued to decline, while prices increased in most markets in the Greater New York City Metropolitan area, according to a report released today by the Hudson Gateway Association of Realtors (HGAR), based on data supplied by OneKey MLS. A limited supply and strong demand are responsible for the current market conditions.

However, as the spring selling season approaches, the region’s home sales sector is bolstered by a noticeable increase in pending sales throughout the region, HGAR officials noted. With the prospect of lower mortgage rates as the Federal Reserve Board considers multiple rate cuts this year, home sales are expected to increase as more homes come to the market beginning in the spring and summer months.

“With mortgage interest rates moving slightly higher now, we continue to experience the trend of people taking a ‘wait and see’ approach before deciding to list their homes for sale, but would caution against trying to time the real estate market based on such marginal changes,” noted HGAR President Carmen Bauman. “Nevertheless, we do anticipate more movement during the Spring with additional inventory on the market.”

Sales of single-family homes declined in all six of HGAR’s coverage areas, while some counties experienced increases in co-op or condo sales. All six regions saw price increases in all property types.

“While it will take some time to have the HGAR home sales market fully reset from the impacts of high inflation and mortgage interest rates, home sales are projected to rise significantly in each of the next two years as the market steadily returns to normal sales activity,’” said HGAR Chief Executive Officer Lynda Fernandez.

In the Bronx, January sales of condos plummeted by almost 46%, while co-op sales dropped 12.6%, followed by single-family homes, with a decrease of 11.6 % as compared to last January. Co-ops experienced the highest median sales price gain to $247,500 – a 38.3% increase from last January. For single-family homes, the median sales price increased 11.3% to $640,000 and 10.7% to $300,000 for condos.

New listings declined for single-family homes, condos, and co-ops at 11.6%, 13.5% and 14.4% respectively. The decline of overall inventory for condos was the highest at 42.2%, followed by single-family homes at almost 32%. Co-op overall inventory dropped by 19.5%. Pending home sales transactions were 10.5% higher in the Bronx in January as compared to January 2023.

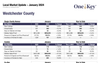

In Westchester County, January sales of single-family homes and co-ops decreased 12.7% and 19.2% respectively, while condo sales increased 1.4% compared to January of 2023. The median sales price increased 5.4% to $858,250 for single-family homes and 31.5% to $562,000 for condos. The median sales price for co-ops decreased 1.6% to $182,000.

New condo listings increased 15.5% while new co-op listings declined 18.3%. New listings for single-family homes decreased by just 2.2%. Overall inventory of single-family homes for sale declined by almost 30%, while co-op inventory was down by 37% and condos, 16.3%. Pending home sales rose 6.9% in Westchester as compared to a year earlier.

In Putnam County, January sales of condos dropped by more than 33.3%, while single-family home sales decreased by 16.3%. There were no co-op sales reported. For single-family homes, the median sales price increased by 11.1% to $500,000, and condos saw a 6.6% hike in sales to $337,500.

New listings for single-family homes saw almost a 16% increase, while the listings for condos remained the same as last year. The overall inventory of single-family homes for sale declined 18.3% while condo inventory remained the same as the previous January. Putnam County’s pending sales increased 5.6% in January as compared to 12 months earlier.

January sales of single-family homes in Rockland County saw just a slight decrease of 0.9% from last year, while condo sales rose by 31% and co-ops by 33%. The median sales price increased 11.1% to $700,000 for single-family homes. Condo prices also climbed 9.2% to $355,00 and co-ops, 9.1% to $221,500.

New listings for single-family homes remained the same as last year, while new condo listings saw a 23.1% hike over January 2023. Co-op listings fell by more than 20%. Co-ops experienced the largest overall inventory decline at 81.1%. Single-family-home inventory overall declined by 19.5% and condos by 3.1%. Pending sales in Rockland County shot up 13.3% in January.

In Orange County, January sales of single-family homes and condos decreased 12.4% and 22.2% respectively, while co-op sales saw no change compared to January of 2023. The median sales price increased 6.0% to $434,300 for single-family homes, 17.0% to $307,000 for condos, and 35% for co-ops.

New condo listings decreased 2.3% for single-family homes, 11.4% for condos, and 33.3% for co-ops. Overall, the condo market experienced the steepest decline in inventory at 33%. Inventory for single-family homes fell by 20% and co-ops, 25%. Pending sales transactions in Orange County rose 6.5% last month.

In Sullivan County, January sales of single-family homes plunged by 41.5% with just 38 sales, compared to 65 last year. There were no condo or co-op sales reported. The median sales price of single-family homes rose by 5.2% to $272,500.

New listings for single-family homes increased by a whopping 53.2% with 72, as compared to 47 last January. Still, overall, the inventory of single-family homes for sale decreased by almost 10% from last January. Pending home sales rose 11.3% In January in Sullivan County.

It should be noted that transactions closed in January involved negotiations started months earlier and do not necessarily reflect current market conditions, HGAR officials noted.

Receive original business news about real estate and the REALTORS® who serve the lower Hudson Valley, delivered straight to your inbox. No credit card required.