New York City Housing Market at a Critical Crossroads: Affordability, Evictions & Fiscal Policy Fuel Uncertainty

For real estate professionals, understanding the human and economic drivers behind eviction filings is critical.

WASHINGTON—A majority of economists surveyed by the National Association for Business Economics believe that the U.S. economy is in recession and do not expect the downturn to end until the latter part of 2020 or the early stages of 2021.

On a darker note, NABE President Constance Hunter, CBE, chief economist, KPMG, said that 80% of panelists indicate there is at least a one in four chance of a “double-dip recession.”

The NABE released its August 2020 NABE Economic Policy Survey today that summarizes the responses of 235 members of the organization. Nearly equal shares of panelists expect the recession to end in the second half of 2020 (35%) or sometime in 2021 (34%). A total of 15% of respondents hold the view that the recession ended in the second quarter of 2020, while 4% expect it will last into 2022 or later.

“Almost half the respondents expect inflation-adjusted gross domestic product to remain below its fourth-quarter 2019 level until the second half of 2022 or later,” Hunter said.

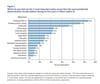

The three most important policy issues for the next presidential administration according to the survey respondents were: Combating COVID-19 (54%), Promoting Economic Recovery (47%) and Health Policy (37%). Rounding out the top 10 were: Climate Change (23%), Immigration Policy (22%), Income Inequality (21%), Budget Deficit (15%), Trade Policy (15%), Entitlement Reform (14%) and Preparing. For Future Pandemics (11%).

A near-majority of respondents (49%) expects real GDP to regain its fourth quarter 2019 level in either the second quarter of 2022 or later, while 30% of respondents expect real GDP to regain its fourth quarter 2019 level sometime in 2021. Only one respondent expects GDP will reclaim its pre-COVID-19 level in 2020. While 41% of panelists expect nonfarm payrolls to regain their February level sometime in 2022, 34% expect that will not occur before 2023, and 18% anticipate it happening in 2021.

“The panel is split in its view on Congress’s fiscal response to the recession, with 40% calling the response insufficient, 37% indicating the response is adequate, and 11% saying it is excessive,” Hunter continued. “Nearly three out of four panelists believe the optimal size for the next fiscal package to be $1 trillion or greater, compared to 17% who favor a smaller package.”

Survey Chair Gregory Daco, chief U.S. economist, Oxford Economics, added, “More than three-quarters of panelists believe that the current stance of U.S. monetary policy is appropriate, the largest share holding this view since 2007.” He noted that the majority of panelists—58%—expects the federal funds rate range to remain unchanged at 0-0.25%, or even drop lower, by the end of 2021. Most participants—84%—expect that the funds rate target will be higher by year-end 2022, but still within 100 basis points of where it is currently.

In terms of their views on the impact of the November Presidential election, a majority of respondents believes that former Vice President Biden would be better at promoting U.S. economic growth than President Trump (62% compared to 25%). Their views on the size of the growth boost diverge, however. Fifty-one percent of panelists overall believe growth would increase, with 29% suggesting a boost of up to 0.5 percentage points, and 22% seeing an increase of more than 0.5 ppt. At the same time, 14% indicate the growth impact of a Biden election would be neutral, and 23% anticipate growth would be lower.

Receive original business news about real estate and the REALTORS® who serve the lower Hudson Valley, delivered straight to your inbox. No credit card required.