HGAR and NYSAR Celebrate Legislative Wins, Prepare for 2026 Advocacy Push

With the full legislature and governor facing re-election in 2026, HGAR and NYSAR are already preparing for what could be a watershed year for housing policy.

National Association of REALTORS® Chief Economist Lawrence Yun believes that better times are ahead for the real estate market in 2024.

WHITE PLAINS—After detailing a laundry list of problems that have caused a “difficult year” for the real estate markets thus far in 2023, NAR Chief Economist Lawrence Yun told a gathering of about 100 HGAR members and affiliates that he believes the home sales market will improve in 2024.

In his first-ever appearance before the HGAR membership, Yun gave a near hour-long presentation on the current state of the residential, commercial and lending markets at the HGAR offices in White Plains on Oct. 10 and concluded his remarks by saying that existing home and new homes sales will improve next year as interest rates begin to fall.

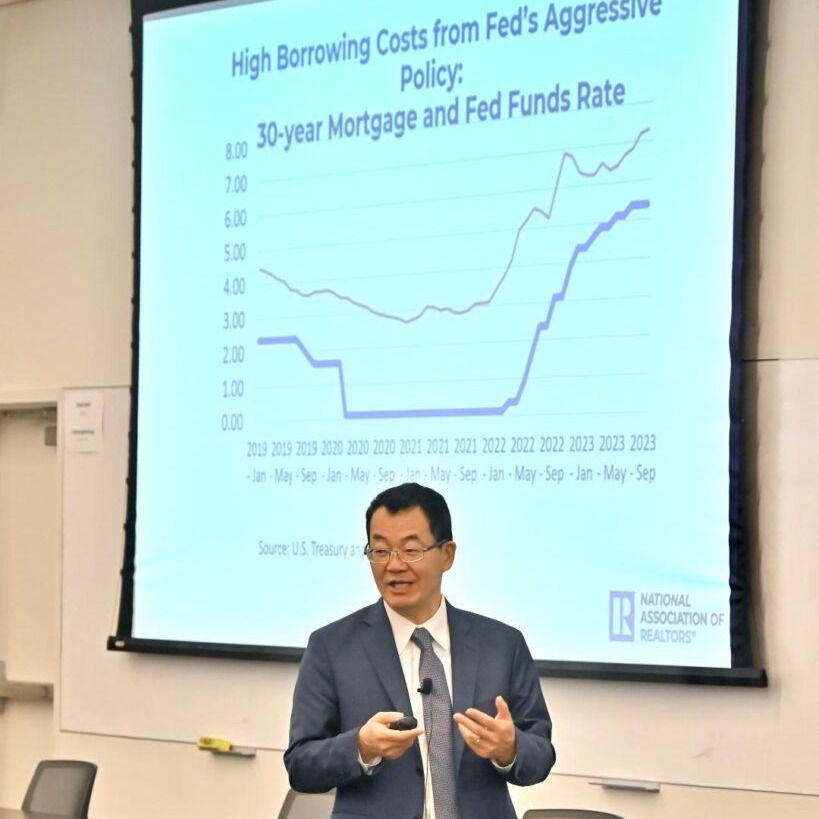

Yun blamed high interest rates, inflation and low inventory for the residential market’s current woes. He said that residential sales as of July 2023 were down 21% as compared to the year before and that current sales are below pre-COVID totals.

“This past year has been a little bit tough on commercial real estate as well as residential,” Yun said. In addition to high interest rates depleting the buyer pool, he noted that there is very little inventory for prospective home buyers to choose from.

While the existing home sales market has suffered in 2023, the new home market has held its own and will likely post an increase in sales as compared to 2022. Yun also predicted that new home sales will rise even further in 2024.

“Right now, transactional activity is down not only because of high interest rates, but because of the lack of listings,” he said.

The high interest rates have caused significant damage to the economy and particularly the real estate markets. In addition, to residential and commercial transactions being lower in 2023, the high rates have resulted in a decline in commercial real estate prices, a crisis in the community banking sector due to an interest rate mismatch and high commercial real estate loan exposure. Earlier this year, Silicon Valley Bank and Signature Bank failed and put the spotlight on the troubles ahead for the community banking sector.

Yun estimated that of the approximately 5,000 community banks nationwide, about 2,000 will be in trouble due to current market conditions. He also predicted that commercial real estate foreclosures will increase over the next two years as loans become due. According to Trepp, there is approximately $270 billion in commercial mortgages held by banks due to expire this year and a total of $1.4 trillion in loans coming due in the next five years.

Yun said that the inflation rate (Consumer Price Index), which was 2% pre-COVID, rose sharply to a high of 9% in 2022, but has since trended sharply downward to 3.7% in August, close to the Federal Reserve Board’s target of 2%. Yun contends that the Fed should pause any further rate hikes to allow the economy to perhaps reach the 2% CPI on its own.

“Stop raising interest rates,” Yun has told the Federal Reserve. “Just give it time. It is trending in the right direction.” He noted that the National Association of Realtors and the National Association of Home Builders recently sent a joint letter to the Federal Reserve requesting a pause in any further interest rate increases for a few months to see if the inflation rate will fall even further in reaction to past interest rate increases.

Yun predicts that come the spring of 2024, lending rates will be in the mid 6% area. He told Real Estate In-Depth that a few months ago he predicted rates would be in the low sixes, but now due to current conditions, he now believes rates will be in the mid sixes in the spring of next year. For the week ended Sept. 29, the Mortgage Bankers Association reported that the average contract interest rate for 30-year fixed-rate mortgage increased for the fourth consecutive week to 7.53%– the highest rate since 2000.

With rates going down, he expects more listings to hit the market and more buyers as well. He said life circumstances will prompt more sellers to put their homes on the market for sale over the next two years. Among the favorable demographic data Yun cited include: 7 million new-born babies, 3 million marriages, 1.5 million divorces, 7 million people turning 65-years old, 4 million deaths and 50 million job switches.

“It has been a difficult two years but I think things will be much, much better next year,” Yun said. “Maybe total sales will still likely be below pre-COVID 2019 conditions, but it will be improved conditions as we go into next year.”

Receive original business news about real estate and the REALTORS® who serve the lower Hudson Valley, delivered straight to your inbox. No credit card required.