New York City Housing Market at a Critical Crossroads: Affordability, Evictions & Fiscal Policy Fuel Uncertainty

For real estate professionals, understanding the human and economic drivers behind eviction filings is critical.

Home sales squeaked out a gain in the final quarter of 2025, helped by improving affordability conditions.

WASHINGTON—Home prices rose in 73% of metro markets (168 out of 230) during the fourth quarter of 2025, according to the National Association of Realtors latest quarterly report released today. That was down from 77% in the third quarter.

Five percent of metro areas (12 out of 230) recorded double-digit price gains, up slightly from 4% last quarter. The national median single-family existing-home price grew 1.2% year over year to $414,900, down from 1.7% annual growth in the third quarter.

“Home sales squeaked out a gain in the final quarter of 2025, helped by improving affordability conditions,” said NAR Chief Economist Lawrence Yun. “Mortgage rates fell, income growth outpaced home price growth, and the income required to buy a typical home declined.”

Yun added, “While most metro markets continue to see record-high housing wealth, some areas are experiencing home price declines. These declining markets are concentrated primarily in Florida and Texas, where robust supply and recent home construction are increasing competition among sellers to attract buyers.”

Northeast: $514,600 (+5.5%)

Midwest: $317,100 (+4.3%)

South: $367,300 (+0.2%)

West: $625,800 (-1.2%)

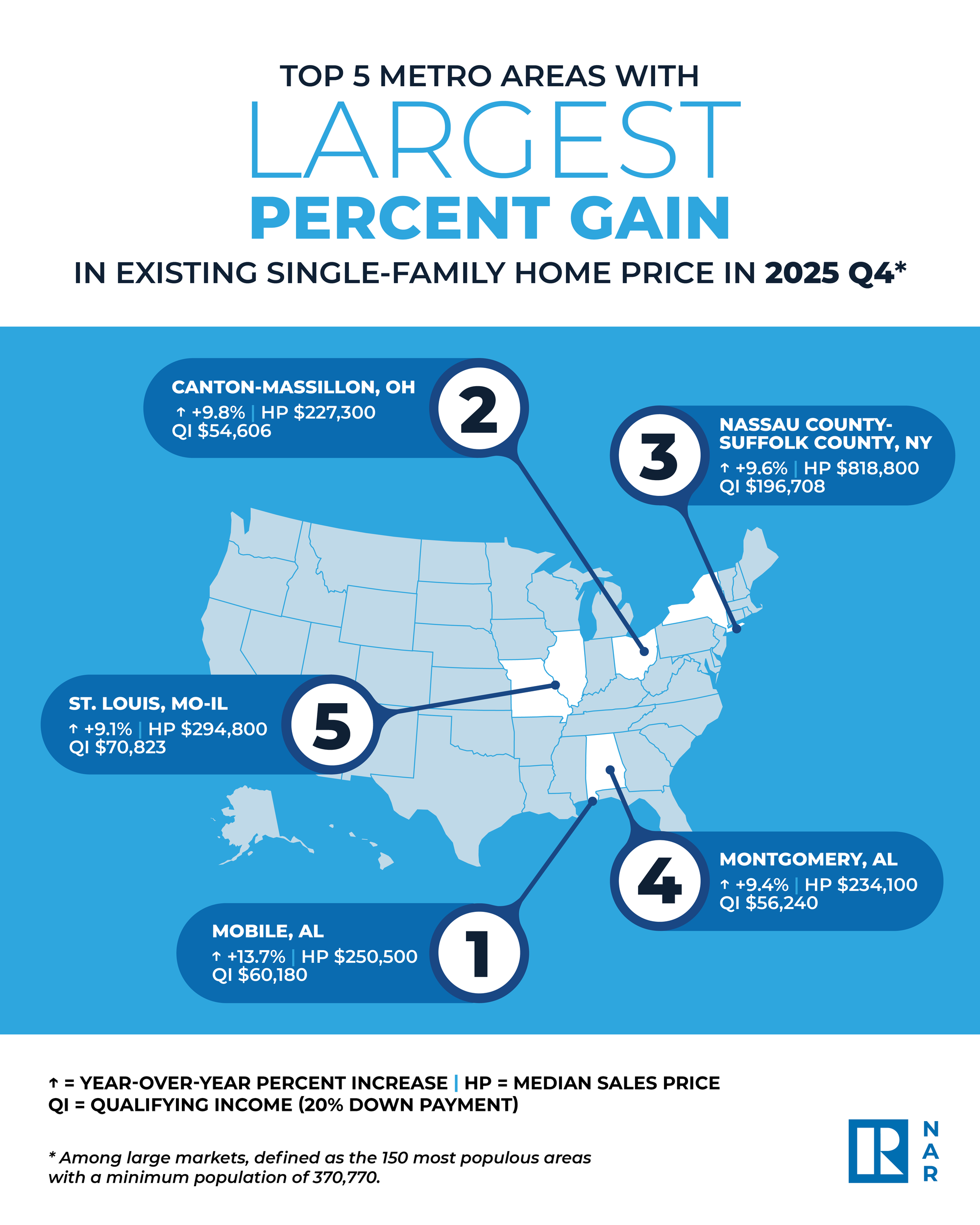

Mobile, AL (+13.7%)

Canton-Massillon, OH (+9.8%)

Nassau County-Suffolk County, NY (+9.6%)

Montgomery, AL (+9.4%)

St. Louis, MO-IL. (+9.1%)

Shreveport-Bossier City, LA (+8.4%)

Youngstown-Warren-Boardman, OH-PA (+8.3%)

Providence-Warwick, RI-MA(+8.2%)

Fort Wayne, IN (+8.0%)

Hartford-West Hartford-East Hartford, CT (+8.0%)

San Jose-Sunnyvale-Santa Clara, CA ($1,920,000; 0.0%)

Anaheim-Santa Ana-Irvine, CA ($1,396,500; +2.7%)

San Francisco-Oakland-Hayward, CA ($1,305,000; -0.8%)

Urban Honolulu, HI ($1,142,100; +3.5%)

San Diego-Carlsbad, CA ($994,000; +0.9%)

Salinas, CA ($955,500; +1.2%)

Los Angeles-Long Beach-Glendale, CA ($939,700; 0.0%)

Oxnard-Thousand Oaks-Ventura, CA ($936,700; +1.8%)

San Luis Obispo-Paso Robles, CA ($917,100; -1.1%)

Nassau County-Suffolk County, NY ($818,800; +9.6%)

Receive original business news about real estate and the REALTORS® who serve the lower Hudson Valley, delivered straight to your inbox. No credit card required.