WASHINGTON—Top experts from the housing and higher-education fields joined policy thought leaders from the National Association of Realtors on Oct. 13 to discuss the current student loan debt crisis and how it affects the economy, housing market, and debt holders. The event explored the findings of NAR’s September report, The Impact of Student Loan Debt, which uncovered that student loan debt is one of the most significant hurdles for potential buyers and their ability to purchase a home.

“Today’s millennials are drowning in student loan debt. After our research, we can now say with certainty that student loan debt is making it difficult to buy a home,” said NAR Vice President of Policy Advocacy Bryan Greene to open the event. “We know that homeownership is the ticket to wealth and equity. Many are concerned that to address student loan debt, we would have to take the load off students and put it on taxpayers. Others advocate help from private employers. We need to talk about all options and explore what reforms are possible.”

Fifty one percent of student loan holders say their debt delayed them from purchasing a home. NAR’s Vice President of Demographics and Behavioral Insights, Jessica Lautz, took the time to explore and explain the research the association has recently done.

“We first started researching this topic because of NAR member’s children—they couldn’t afford a home because of the burden of student loan debt. We knew they weren’t alone because there are 40 million Americans holding student loan debt,” said Lautz. “Half of non-owners say student loan debt is delaying them from buying a home. We asked participants in our research to pretend they paid off their student loan debt—they said the first thing they would invest in is long-term savings and the second would be buying a home. So, we know they want to get into homeownership, but they are having a hard time getting there.”

The Mortgage Bankers Association spoke about today’s competitive housing market. Detailing that in the current market candidates are faced with other buyers offering all-cash offers and a competitive bidding process. As a result of intense competition, MBA supports assistance in down payment which is clearly needed for first time homebuyers specially in low-income areas. Senior Vice President of Public Policy for the National Fair Housing Alliance Nikitra Bailey went on to outline how student loan debt has a disproportionate effect on people of color. NAR’s research shows White student debt holders (30%) are less likely than Black (47%) or Hispanic (47%) debt holders to say they are currently incurring student loan debt for themselves.

The National Association of Realtors released its report “The Impact of Student Loan Debt” last month.

“Today Black homeownership is as low as it was when discrimination was legal,” said Bailey. “After 20 years of taking out student loans, Blacks still owe 95% of the balance of the debt and are more likely to default. Post-secondary education is now a necessity to succeed, yet a degree is not a shield from racial disparity. Our proposed Down Payment Targeted Assistance Program addresses student loan debt as a burden that leads to the lack of ability to save for a down payment, mostly among Blacks and Latinos. And our Keys Unlock Dreams Initiative will help close the racial wealth and homeownership gap.”

Rachel Fishman, Deputy Director for Research, Higher Education at New America detailed the burden on parents who take out Parent PLUS loans. These federal loans continue to be an in between space where parents take on the student loan debt of their child.

“When we talk about student loan debt we talk about the student, but we need to start correlating the family,” said Fishman. “My hope is to raise awareness about this issue… to start addressing the root cause of debt—food insecurity, housing affordability, childcare. Families are juggling these things on balance sheets along with student loan debt. Among other recommendations, we seriously need to address college affordability for a four-year degree.”

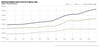

The last speaker for the event was Ben Kaufman, Head of Investigations & Senior Policy Advisor at the Student Borrower Protection Center. He closed the forum with statistical intel that outlined the chronological timeline showing the increasing financial instability that student loan debt is creating in this country and how it is standing in the way of people being able to purchase a home.

“Student loan debt has exploded in the US. There are more people borrowing, and they are borrowing more. People think of a student loan debt holder as young person, but actually two-thirds of borrowers are over the age of 30,” said Kaufman. “Even before COVID, the rate of delinquency on student loans was higher than the delinquency on mortgages at the peak of the financial crisis. Before COVID, a borrower was defaulting on a student loan every 26 seconds. So much of this is policy choices, for generations every single day in Washington all levels of government have been making decisions on this. It is imperative to claim your seat at the table so your voices can be heard. If your voices were heard from the onset, I don’t think we would see the consequences we see today.”