BRI Says Westchester Rent Hike Falls Short; Warns of Long-Term Consequences

BRI officials stated that while the new increases prevent another destructive rent freeze, they once again fall short of what is required to keep up with rising costs.

A key data point will be the CPI reaching its 2% target. The latest CPI number for February was 3.1%.

WASHINGTON—While the Federal Reserve Board is not expected to lower mortgage lending rates later this month, National Association of Realtors Chief Economist Lawrence Yun believes that once inflation hits the Fed’s target of 2% it will then seriously consider instituting multiple cuts this year and next.

In fact, during NAR’s virtual “Real Estate Forecast Summit: Commercial Update” held on March 7, Yun predicted that the Federal Reserve will cut rates maybe four to six times in the next two years. Yun and Igor Popov, chief economist at Apartment List, offered 2023 data on the commercial markets, including the multifamily sector, and their views on how they will perform in 2024.

He said that Federal Reserve Chairman Jerome Powell has stated that the Fed could cut rates three times in 2024, but its decision will be based on data. A key data point will be the CPI reaching its 2% target. The latest CPI number for February was 3.1%.

One contributor to the high CPI has been apartment rent growth. Yun believes that rents are now moderating and will continue to do so, which will help the CPI eventually get to the Fed’s 2% target rate.

Among some of his other prognostications include that the 10-year Treasury yield settling down at 3.5%; commercial property prices will stabilize, with the exception of office buildings; the U.S. will register moderate GDP growth in 2024 which will bolster net leasing and investment sales and both the land and single-family development sectors will perform well.

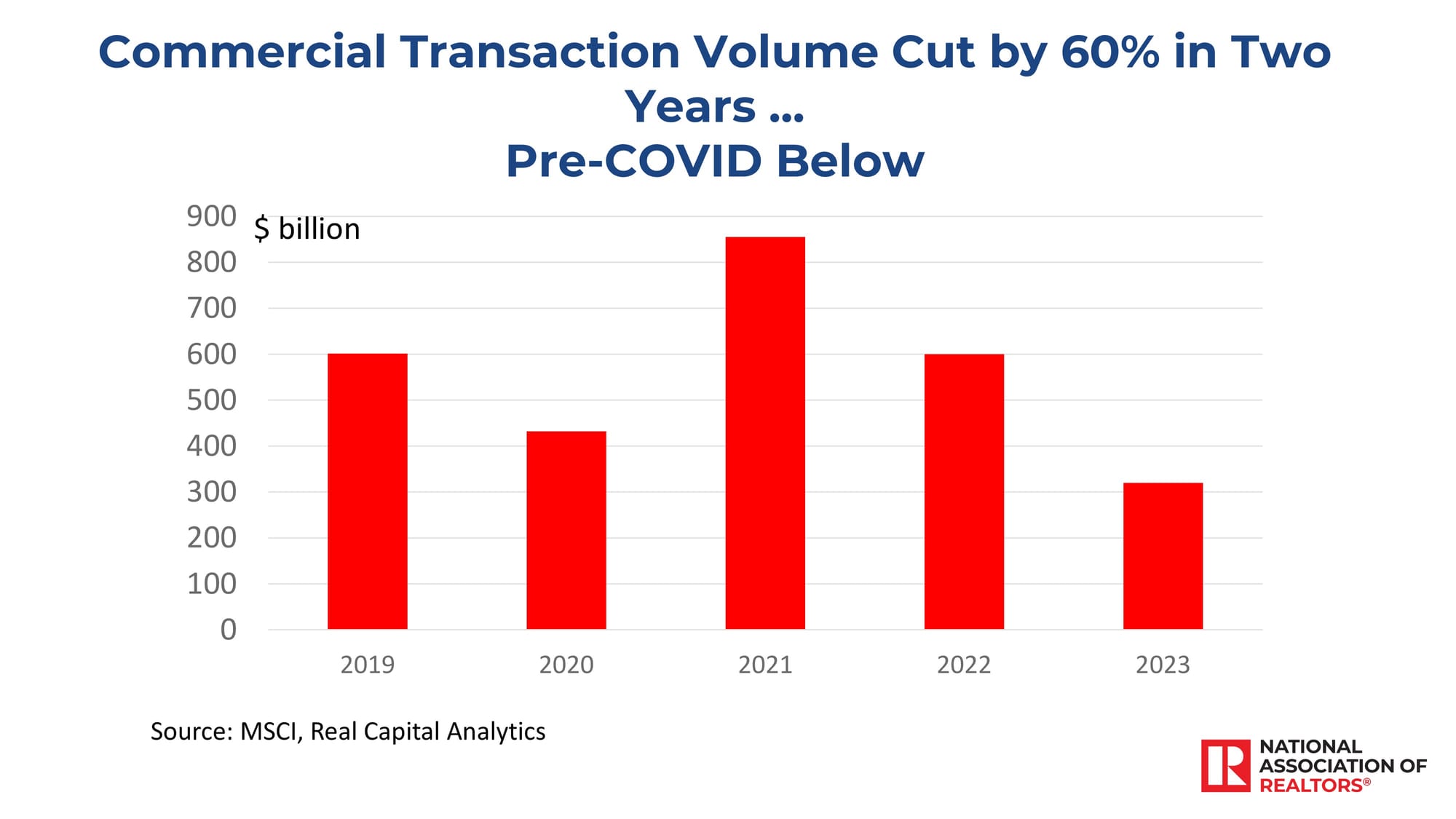

Yun noted that overall commercial real estate transactions fell 60% in 2023 as compared to 2021 due to high-interest rates. He said that early indications for this year indicate that retail and warehouse leasing activity will be slightly lower than last year.

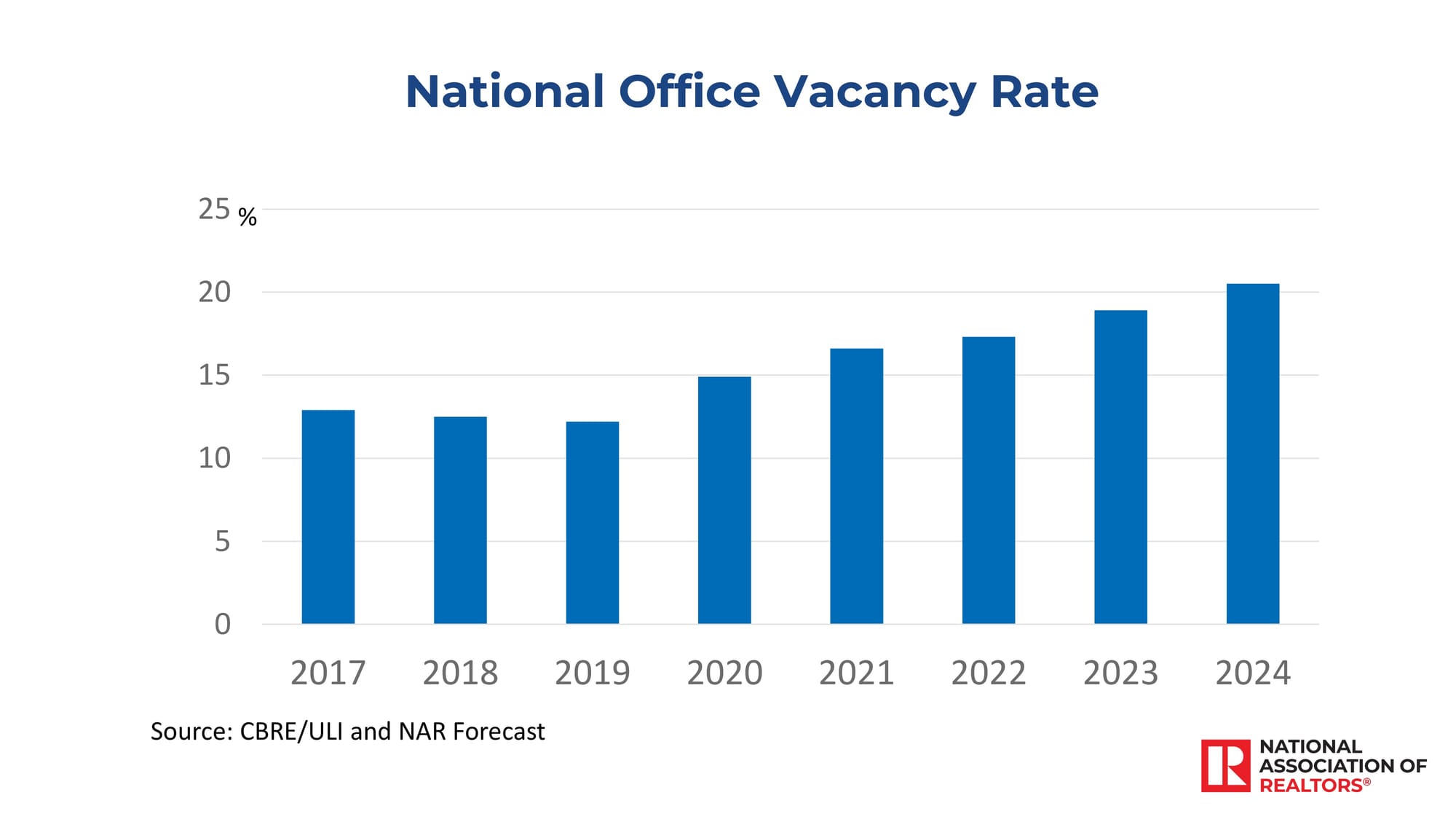

In terms of the troubled office market, Yun said, despite the continued strong job creation, “People are saying, ‘We don’t need offices.’” He said that while some estimate the overall national office vacancy rate is about 15%, the non-utilization rate may be between 60% to 70%. Yun said that many companies will likely renew their leases, but cut back the size of their leased space. Therefore, he expects negative office space absorption over the next few years and the national office vacancy rate to rise above 20% this year.

Yun added that the delinquency rate on office properties has been rising and will continue to trend higher in 2024.

On a positive note, he reported that hotel occupancy rates are back to pre-Covid levels at more than 60% and he predicts the rate will rise above 65% by the end of 2024.

Both Yun and Popov believe that there is a lag between actual apartment rent prices and that the CPI’s apartment rent figures are not up to date. “We know that market rent growth peaked almost six quarters ago. It takes time—we now estimate it takes about six quarters—for most of the rent deceleration growth to actually factor into the CPI,” Popov said.

He said this is good news for inflation and the prospect of future rate cuts because the Fed knows that private indices have reported the rapid deceleration of rent growth or “the evaporation of rent growth entirely.”

Popov said that the Sunbelt metro areas are reporting the slowest rate of rent growth due to the significant supply coming onto the market, while metro areas in the Midwest are showing the fastest rent growth.

He predicted that due to the large supply of new apartment product expected to hit the market in 2024, “We are going to see a real dearth of new apartments coming online towards the end of 2025 and in 2026 because that will be the lag effect of the current high-interest rate environment.”

Popov said that in much smaller numbers than the new apartment market, the build-to-rent single-family development market is surging at the moment.

Receive original business news about real estate and the REALTORS® who serve the lower Hudson Valley, delivered straight to your inbox. No credit card required.