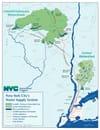

NEW YORK—The New York City Department of Environmental Protection recently reported it had paid $165 million in local village, town, city, county and school taxes throughout 2023 across nine Hudson Valley and Catskill counties covering its water supply system that serves nearly half of the state’s population.

With this year’s payments, DEP remains a top taxpayer throughout many municipalities and schools in and near the watershed region, paying taxes on the full-assessed value of land, structures, easements, and most water supply infrastructure across the approximately 230,000 acres owned or controlled by New York City for the water supply system.

“While delivering the highest quality water possible to half the State’s population, DEP is also proud to help support our neighbors and host communities who make it possible,” said DEP Commissioner Rohit T. Aggarwala. “From economic development incentives to watershed protection programs and full local property taxes, DEP directly infuses hundreds of millions of dollars to local communities each year throughout the water supply region.”

DEP pays property and school taxes at full assessed value on all land, reservoirs, dams and structures across the approximately 230,000 acres it owns or controls throughout the 2,000-square-mile watershed in the Hudson Valley and Catskills, including the tens of thousands of acres open to the public for recreational purposes such as hiking, fishing, hunting and boating, as well as on property used for agricultural purposes. Piping and aqueducts used to convey water are tax exempt. Taxes are paid on all properties originally acquired to build the 19 upstate reservoirs and three controlled lakes between the mid-19th and mid-20th centuries (about 78,000 acres), and all land and assets acquired since to operate the supply system and as buffer land to help protect water quality (approximately 156,000 acres).

In 2023, DEP was among the top taxpayers in numerous municipalities and school districts across the watershed region. DEP paid more county government property taxes than any other property owner in Ulster, Delaware, Putnam and Schoharie counties, and was the second highest in Westchester County.

Of the total $165 million in taxes DEP paid, more than $105 million went directly to public schools throughout the nine-county region. For example, in Delaware County DEP taxes made up about a third of the total tax levy for the Deposit Central School District and two-thirds of the Downsville Central School District, with significant payments to others throughout the county. In Sullivan County, DEP covered more than half of the entire tax levy for the Tri-Valley Central School District (which spans into part of southwestern Ulster County).

In Schoharie County, DEP taxes made up half the total tax levy for the Gilboa-Conesville Central School District. In Ulster County, DEP taxes covered more than a third of the Ellenville Central School District tax levy and close to 20 percent of the Onteora Central School District’s total levy. In Westchester County schools, DEP taxes made up more than 20% of the Valhalla Union Free School District’s total tax levy, more than 30% of the Pocantico Hills Central School District levy, 10% of the North Salem Central School District Levy, and made significant payments to others throughout the county. In Putnam County, DEP paid more than 5% of the total tax levies in each the Mahopac, Carmel and Brewster central school districts.

DEP also has an authorized head count of more than 1,000 employees throughout the upstate watershed and water supply system.

“Most of those employees call the water supply region home, with many who raise families, shop, own homes, pay taxes and educate their children in the myriad communities we work hand-in-hand with to deliver the best quality water possible,” said DEP Deputy Commissioner Paul V. Rush of the Bureau of Water Supply.

DEP’s 2023 local property and school tax payments by county were:

Delaware County

On 1,224 parcels, DEP paid $6,472,930 in county property taxes and $12,213,348 in school taxes.

Dutchess County

On 39 parcels, DEP paid $50,243 in county property taxes and $465,765 in school taxes.

Greene County

On 452 parcels, DEP paid $519,394 in county property taxes and $1,218,627 in school taxes.

Sullivan County

On 131 parcels, DEP paid $4,545,463 in county property taxes and $11,110,872 in school taxes.

Ulster County

On 556 parcels, DEP paid $4,023,772 in county property taxes and $18,150,709 in school taxes.

Orange County

On 21 parcels, DEP paid $12,972 in county property taxes and $91,661 in school taxes.

Putnam County

On 486 parcels, DEP paid $2,046,350 in county property taxes and $17,457,522 in school taxes.

Schoharie County

On 100 parcels, DEP paid $2,729,013 in county property taxes and $3,372,293 in school taxes.

Westchester County

On 502 parcels, DEP paid $7,191,811 in county property taxes and $41,389,530 in school taxes.