OneKey MLS: Year-End Regional Housing Data Shows Steady Sales and Price Growth

Single-family homes led the market with 3,229 closed sales, reflecting a 1.4% increase over the previous year.

FARMINGDALE, NY—The OneKey MLS December 2025 Market Report highlights a regional housing market that closed the year with measured growth, resilient demand, and continued price stability across the region’s diverse housing segments.

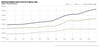

Across the OneKey MLS service area, total closed sales increased 1.5% year-over-year, reaching 4,303 transactions, with gains across single-family homes, condominiums, and co-ops. Median sales prices continued their upward trajectory, rising 3.8% year-over-year to $675,000, reflecting sustained buyer confidence amid constrained inventory.

Single-family homes led the market with 3,229 closed sales, reflecting a 1.4% increase over the previous year. The median sales price for single-family homes rose to $740,000, up 4.2% from December 2024. Condominiums saw a median price increase of approximately 9.0%, while co-ops rose by 8.9%. Pending sales for all property types increased by 12.8%, indicating positive momentum entering early 2026.

Inventory remained tight, with total homes for sale down 9.0% year-over-year, helping to keep days on market relatively low. Properties sold in a median of 54 days, nearly 7% faster than one year ago, while sellers continued to receive close to the asking price, averaging 98.6% of the original list price.

“December’s data shows a market that continues to move forward with discipline and durability,” said Richard Haggerty, CEO of OneKey MLS. “Even with ongoing inventory challenges, buyers and sellers remained engaged through year-end, and the strength we’re seeing in pending sales and pricing points to a constructive start for 2026. These trends reflect the adaptability of our professionals and the enduring appeal of our region.”

“While the chill of December swept through the Hudson Valley, our real estate market kept some spark. Across the HGAR region, we're seeing subtle signs of stabilization that give us reason to feel cautiously optimistic,” said 2026 HGAR President Rey Hollingsworth Falu. He noted that Westchester posted a 7.5% jump in median sale price while Orange, Putnam and Rockland counties “played it cool. Interest rates are creeping down and politicians are talking about housing. This market is evolving, not evaporating.”

He added: “Buyers are adjusting to rates with creative financing, and inventory, though still tight, is finding movement as sellers begin to recalibrate expectations. We’re not just surviving winter; we’re warming up for what we believe could be a more active spring. At HGAR, we’re preparing our members for this next chapter with new tools, smarter advocacy, and more strategic data. Whether it’s the Bronx’s double-digit bump in median price or Rockland’s growing appeal, we’re seeing opportunity in every corner of our territory. If 2025 was the year of recalibration, 2026 is shaping up to be the year of reactivation. We’re tied to success, and that tie is getting stronger.”

Looking ahead, market activity is expected to remain steady as demand continues to outpace available inventory. With buyer engagement holding firm and pricing trends showing resilience, the region enters 2026 on a solid footing, OneKey MLS officials stated.

HGAR Market Area Snapshot-December 2025

Note: All December 2025 data is in comparison to activity 12 months prior.

NYC Metro Region

Single-Family Median Home Sale Price: $735,000, up 4.9%

Single-Family Home Sales: 3,418, up 2.1%

Condo Median Sale Price: $549,345, up 8.8%

Condo Sales: 588, up 2.1%

Co-Op Median Sale Price: $310,000, up 10.7%

Co-Op Sales: 519, up 1.0%

Single-Family Inventory: 8,207, down 10.5%

Note: The New York City Metro Region covers: Westchester, Rockland, Orange, Putnam, Sullivan, and Dutchess counties in the Hudson Valley, Nassau and Suffolk counties and the boroughs of the Bronx and Queens.

HGAR Market Area

Bronx County

Single-Family Median Home Sale Price: $650,000, down 6.5%

Single-Family Home Sales: 44, up 10%

Condo Median Sale Price: $320,000, up 10.7%

Condo Sales: 13, flat as compared to December 2025

Co-Op Median Sale Price: $303,750, up 25.3%

Co-Op Sales: 44, up 10.0%

Single-Family Inventory: 212, up 9.3%

Orange County

Single-Family Median Home Sale Price: $465,000, down 2.1%

Single-Family Home Sales: 241, down 1.6%

Condo Median Sale Price: $317,000, down 0.9%

Condo Sales: 35, up 9.4%

Co-Op Median Sale Price; $80,500, down 42.9%

Co-Op Sales: 1, down 50%

Single-Family Inventory: 747, up 1.8%

Putnam County

Single-Family Median Home Sale Price: $548,750, down 1.9%

Single-Family Home Sales: 102, up 50%

Condo Median Sale Price: $431,000, up 12.8%

Condo Sales: 18, up 80%

Co-Op Median Sale Price; $210,000

Co-Op Sales: 1

Single-Family Inventory:125, down 12%

Rockland County

Single-Family Median Home Sale Price: $725,000, up 1.0%

Single-Family Home Sales: 164, up 11.6%

Condo Median Sale Price: $470,000, up 13.3%

Condo Sales: 45, down 28.6%

Co-Op Median Sale Price: $122,450, down 12.5%

Co-Op Sales:6, down 14.3%

Single-Family Inventory: 362, up 27.0%

Sullivan County

Single-Family Median Home Sale Price: $372,000, up 9.0%

Single-Family Home Sales: 80, up 1.3%

Condo Median Sale Price: $325,000

Condo Sales: 1

Single-Family Inventory: 422, up 2.9%

Westchester County

Single-Family Median Home Sale Price: $980,000, up 7.5%

Single-Family Home Sales: 428, up 13.2%

Condo Median Sale Price: $540,000, up 11.9%

Condo Sales: 101, down 1.0%

Co-Op Median Sale Price: $242,500, up 7.8%

Co-Op Sales: 148, down 1.3%

Single-Family Inventory: 477, down 12.2%

SOURCE: ONEKEY MLS

To access all local and regional housing market reports, visit https://marketstats.onekeymls.com