President Biden Unveils New Housing Supply Action Plan Promising to Close Housing Supply Gap in Five Years

WASHINGTON—The initial reaction from the real estate industry to President Biden’s Housing Supply Action Plan that looks through a variety of measures to increase the affordable housing stock in the United States by preserving and building hundreds of thousands of units and closing the housing supply gap in the country within the next five years was generally favorable.

President Biden released the plan on May 16. Administration officials termed the Housing Supply Action Plan as “the most comprehensive of all government effort to close the housing supply shortfall in history.”

The plan comes after President Biden’s $1.75-trillion Build Back Better plan stalled in Congress back in December. Build Back Better called for $150 billion in funding for the construction and rehabilitation of more than 1 million affordable rental and single-family homes. No cost estimates were released on the Housing Supply Action Plan.

Under the plan, the administration will:

• Reward jurisdictions that have reformed zoning and land-use policies with higher scores in certain federal grant processes, for the first time at scale.

• Deploy new financing mechanisms to build and preserve more housing where financing gaps currently exist: manufactured housing (including with chattel loans that the majority of manufactured housing purchasers rely on), accessory dwelling units (ADUs), 2-4 unit properties, and smaller multifamily buildings.

• Expand and improve existing forms of federal financing, including affordable multifamily development and preservation. This includes making Construction to Permanent loans (where one loan finances the construction but is also a long-term mortgage) more widely available by exploring the feasibility of Fannie Mae purchase of these loans; promoting the use of state, local, and Tribal government COVID-19 recovery funds to expand affordable housing supply; and announcing reforms to the Low Income Housing Tax Credit (LIHTC), which provides credits to private investors developing affordable rental housing, and the HOME Investment Partnerships Program (HOME), which provides grants to states and localities that communities use to fund a wide range of housing activities.

• Ensure that more government-owned supply of homes and other housing goes to owners who will live in them—or non-profits who will rehab them—not large institutional investors.

• Work with the private sector to address supply chain challenges and improve building techniques to finish construction in 2022 on the most new homes in any year since 2006.

Some of the funding highlights from the administration’s announcement include: The Unlocking Possibilities Program, proposed by President Biden and included in the reconciliation bill passed by the House last year, would establish a new, $1.75-billion competitive grant program, administered by HUD, to help states and localities eliminate needless barriers to affordable housing production, including permitting for manufactured housing communities.

Building on the Unlocking Possibilities Program, the President’s 2023 Budget includes a mandatory spending proposal that would provide $10 billion in HUD Grants to Reduce Affordable Housing Barriers for states and localities that have already adopted Housing Forward policies and practices to address challenges to housing supply production constraints. While Unlocking Possibilities would help states and localities undertake reform, the Housing Supply Fund would reward those that have already made reforms by giving them additional funding to boost the affordability and maximize the benefits of their new policies. This funding would also support broader housing development activities, including environmental planning and mitigation, road infrastructure, and water or sewer infrastructure, the administration stated.

In addition, the plan calls for the financing for the development of 500,000 units of housing for low- and moderate-income renters and homebuyers. The President’s 2023 Budget includes a proposal for $25 billion for grants for affordable housing production. These resources would be distributed to state and local housing finance agencies and their partners, territories, and tribes, and would be focused on streamlining financing tools to reduce transaction costs and increase housing supply through multifamily and single-family housing units of modest density (up to 100 units per site). HUD will encourage grantees to develop housing that directly meet identified local needs, especially housing that is not sufficiently provided by the market. This includes intergenerational housing, investments that place vacant or underutilized properties back into productive use, ADUs, and novel and non-traditional development techniques, including modular, panelized, or manufactured housing. States and localities would have flexibility to design their programs to meet local needs, and the resources would be used to support renters and homebuyers with up to 150% of area median income in high-cost areas.

A host of real estate and finance organizations came out in support of the plan. Mortgage Bankers Association’s President and CEO Bob Broeksmit, CMB, stated, “MBA commends the Biden administration for announcing steps to alleviate the acute shortage of single-family and multifamily housing for prospective homebuyers and renters. Eliminating the regulatory barriers to new construction, including manufactured housing, in underserved markets; expanding affordable financing for multifamily development and rehab projects; and a commitment to more private and public sector partnerships will help address the housing supply and affordability challenges that continue to burden families.”

Broeksmit added that the MBA strongly encourages HUD to focus on the issues that continue to lead to significant lending pipeline delays in its MAP program, which is a primary financing option for producing more affordable rental housing.

Jerry Konter, chairman of the National Association of Home Builders, said, “The plan contains many positive elements that would help address a host of affordability challenges and improve financing options, and acknowledges the long-term headwinds, like supply chain bottlenecks and chronic construction labor shortages, repeatedly identified by NAHB members as holding back housing production. We agree with the White House that the key to resolving our nation’s housing affordability challenges is to build more homes. NAHB looks forward to working with the Biden administration and Congress to provide a comprehensive long-term solution to the affordability crisis that will enable builders to construct more affordable entry-level housing, raise minority homeownership rates, and shore up the national economy.”

The National Apartment Association and the National Multifamily Housing Council also applauded the Biden administration for recognizing the nation’s critical shortage of affordable housing and developing a comprehensive package of regulatory and legislative measures to help address it.

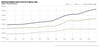

In a joint statement, the two organizations stated: “The administration’s thoughtful proposal rightly acknowledges that there is no single magic bullet that can solve our housing shortage. It is the result of decades of policy failures to address a growing shortage of housing production that has resulted in today’s crisis. In fact, research conducted by Hoyt Advisory Services has found that through 2030, the U.S. will need to build an average of 328,000 apartments every year. That mark has only been achieved five times since 1989. This crisis predates the pandemic and therefore it is critical that local, state and federal governments, along with the private sector, do all they can to reduce regulatory burdens and encourage the development and rehabilitation of housing of all types and price points.”