WHITE PLAINS—With a backdrop of rising interest rates, slowing buying demand, high inflation and a turbulent stock market, some industry observers are questioning the strength of the residential sales market and forecasting hard times ahead.

With the recent 0.75% increase in the short-term benchmark lending rate by the Federal Reserve to try and tame high inflation and with more rate hikes expected in the months ahead, a dark cloud hovers over the residential sales market. The rate increases are an attempt to control inflation, which in May stood at 8.6%, the highest level since December 1981.

NAR Chief Economist Lawrence Yun released a statement in reaction to the Federal Reserve’s rate increase that clearly predicted a slowdown in the home sales market.

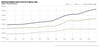

“Today’s announcement by the Federal Reserve set a big increase in interest rates and means several more rounds of rate hikes are on the way in upcoming months. So far, the short-term fed funds rate that the Fed directly controls has risen by 175 basis points. But the 30-year fixed rate mortgage has risen even more—by nearly 300 basis points. On the same $300,000 mortgage, the monthly payment has risen from $1,265 in December to $1,800 today. That’s painful and, consequently, will shrink the buyer pool,” Yun said.

He continued, “Home sales have recently been trending down towards 2019 figures. Sales could fall even further with some inventory sitting on the market for more than a month like in the pre-pandemic days. Pricing a listed home properly will, therefore, be the key to attracting buyers. In the meantime, rental demand will strengthen along with rents. Only when consumer price inflation tops out and starts to fall will mortgage rates stabilize or even decline a bit. That is why providing additional oil supplies will be critical in containing consumer prices and interest rates.”

Real Estate In-Depth decided to reach out to some prominent Realtors in the region to learn their views on current conditions and where they see the market going forward. The consensus is that in all areas and all price points, activity is down, but conditions still remain strong.

Joseph Rand, Chief Creative Officer of Howard Hanna | Rand Realty, said that people make a mistake comparing 2022 activity to 2021 or even 2020 because the latter were two of the best years in the history of the market. He contended that a better comparison is with 2019, which was still a pretty good year but not supercharged by impacts of the coronavirus,

“Compared to 2019, year-to-date 2022 we’re up between 10% to 20% in sales in every regional county, and up more than 30% in the regional average sales price,” Rand said. “If you’re a real estate professional, that’s probably a 50% increase in volume, which is how we earn our living.”

Looking ahead, Rand stressed that while sales will be down, the market will still be strong on a historical basis. “I expect that both the increase in rates and the instability in the economy is going to drive sales down, well below the last two years and probably close to the last ‘normal’ year of 2019. But, I still think we’ll have moderate price appreciation for the year, nothing like the double-digit appreciation of the last two years but more like 6% to 7% for the region. That’s not bad!” he said.

HGAR President-Elect Tony D’Anzica said that recently he has definitely seen a slowdown in activity. The Broker/Owner of Dynamax Realty NYC, Inc., which operates in New York City and Central New York, said, “I do see the markets slowing down (in both New York City and upstate) and I am starting to see price decreases and I am starting to see people listing their homes for market value, whereas six months ago, eight months ago, a year ago, I saw sellers wanting to list their homes for astronomical prices that the market could not bear.”

D’Anzica said that he is seeing a slowdown, but characterized conditions as still a “seller’s market.” However, he expects that will last for another six to 12 months. He added that he is starting to see some buyer nervousness with the rising lending rates, but that at present with still low inventory, there are still enough buyers in the market to absorb the available listings.

Carmen Bauman, HGAR Treasurer and Principal Broker of Green Grass Realty Corp. of Bronxville, said that there is a natural slowdown in activity in the summer months and inventory remains low in her market area in the New Rochelle-Bronxville region. “I have noticed that buyers have a little more leverage due to the rising interest rates, but that is dependent on pricing,” Bauman said.

She added that homes priced over $1 million are still seeing significant buyer interest, while homes priced under $1 million are being impacted somewhat since buyers for those homes are more affected by rising interest rates. Bauman said that owners of homes that do not sell after their first or second open house are now reducing prices to spur activity. While she sees a slowdown, Bauman does not see any indication of any type of collapse in 2022 or 2023.

Charlie Oppler, Co-Broker/Owner and CEO of Prominent Properties Sotheby’s International Realty of Franklin Lakes, NJ, said that in his market areas of Northern New Jersey and Rockland County there has been a slowdown in unit sales due to a number of factors, including inflation, high interest rates and low inventory. Sales prices have leveled off in some markets, but have increased in some cases by double-digits in popular locations.

The 2021 NAR President said that demand is still high, but not at the frenzied pace of 2020 and 2021. “You may not see 20 offers on a property, now you will see six,” he said. “But, I think that is a function of interest rates and inflation.”

Oppler is bullish on the market going forward despite the current headwinds. “I am not worried about a collapse,” he told Real Estate In-Depth. “The reason is because if you look at 2008 to 2013 you had no-income verification loans, stated income, a lot of mortgages that were not counting on appreciation to cover the buyer. This marketplace the last three, four or five years, we have not seen a huge increase in the mortgage amount, we are seeing a lot more cash down on the big purchases and or just straight-out cash purchases, which means that the buyer can hold onto their property.”

The rise in interest rates are going to impact first-time buyers and price some out of the market. “That is where the big challenge will be,” Oppler said.

HGAR President Anthony Domathoti said that while activity has slowed down, there is no indication of any market collapse. “In my region as a whole, I would not say there has been a decline, but a slowdown because of the lack of inventory and rising interest rates.” The Broker-Owner of EXIT Realty Premium added that some buyers are a little careful before they make the decision to enter the market.

Dorothy Botsoe, President and CEO of Dorothy Jensen Realty, Inc. of White Plains, said that the foreclosure/distressed property market is picking up due to the expiration of COVID eviction moratoriums. However, the conventional home sales market, particularly the first-time-buyer segment, is slowing down.

“The buyers are taking a breath,” she said. “They are thinking before they jump and give that over-priced offer.” Botsoe said that rising interest rates have priced some first-time home buyers out of the market. She said that higher lending rates have definitely given some prospective homebuyers pause before they make an offer.