West of Hudson Transit Study Launched

The West of Hudson Transit Study will center on service improvements to bus networks, including local routes, regional commuter bus service, and micro-transit.

WHITE PLAINS—Realtors believe that the lower home sales numbers registered in the first quarter of this year were due primarily to record low inventory and not any sharp decline in buying demand. In fact, brokers interviewed by Real Estate In-Depth agree that current economic headwinds in the form of high inflation, rising mortgage interest rates and the war in Ukraine have done little to date to dampen buyer enthusiasm.

If these market conditions continue, low inventory will cause lower sales, but in no way will foster any type of market collapse, brokers agreed.

According to the recently released first quarter 2022 market report for counties served by OneKey MLS, LLC, residential sales were down from the historic peaks of 2021, but still posted strong results when compared with 2019 and 2020. The one county served by OneKey MLS that posted stronger numbers in 2022 compared to 2021 was Bronx County which saw sales increase 6.1% in the first quarter of 2022.

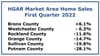

Residential sales, which include single-family homes, condominiums, co-operatives and 2-4 family multi-family homes, decreased 6.3% in Westchester County, fell 28.1% in Putnam County, declined 11.6% in Rockland County, decreased 14.7% in Orange County, and were 19.8% lower in Sullivan County. A bright spot when comparing 2022 sales to 2021 sales was the condominium market in Westchester County which saw a 27.8% increase in the number of transactions and an 18.7%. increase in its median sale price to $445,000.

However, the OneKey MLS report stressed that the first quarter 2022 sales market was still strong when the 2022 first quarter residential sales numbers are compared to the first quarter of 2020. Those comparisons indicate that the sales numbers in Westchester County increased 26.9%, Putnam County sales rose 16.7%, Rockland County sales were 21.2% higher, Orange County transactions increased 31.7%, Sullivan County closings shot up 30.5% and Bronx County transactions rose an impressive 42.2%.

In all areas served by OneKey MLS single-family median sales prices continued to rise, with a modest increase of 2.7% in Westchester County to $729,000, a 21.8% increase in Putnam County to $475,038, a 14.9% increase in Rockland County to $600,000, a 10.3% increase in Orange County to $375,000, a 20.3% increase in Sullivan County to $267,000 and an 11% increase in Bronx County to $600,000.

The alarming data continues to be available inventory. At the end of the first quarter of 2022, Westchester’s for-sale single-family home inventory was down 26.5%; Putnam County’s single-family inventory fell 10.9% lower; Rockland County’s single-family inventory plummeted 30.0%; Orange County’s stock of available single-family homes were 9.8% lower; and Sullivan County’s single-family inventory fell 5.4%. Bronx County’s single-family inventory was the outlier with an increase of 18.3% in the number of houses on the market for sale at the end of the quarter.

HGAR President Anthony Domathoti, who is Broker/Owner of EXIT Realty Premium of the Bronx, told Real Estate In-Depth that buyer demand was strong in the first quarter of 2022 despite low inventory.

He added that limited inventory will continue to plague the markets in the days to come and available listings will sell fast.

“The market is facing dual headwinds—rising interest rates and increasing inflation,” Domathoti said. “However, the market continues to grow in spite of these challenges as the economy in the Hudson Valley and Greater New York City area continue to rebound from the pandemic. So, all-in-all, 2022 is off to a solid start.”

Rising mortgage interest rates will make home purchases more expensive, which will chip away at home buying demand. He expects slower sales in 2022, but by no means will there be a sharp decline in activity.

Domathoti singled out the Bronx where 477 co-ops were sold last year. “The Bronx is very active right now,” he added. Inventory in the Bronx remains low and available listings are selling very fast.

Joseph Rand, chief creative officer of Howard Hanna | Rand Realty, stated in the firm’s first quarter market report that low inventory has suppressed pending transactions. “If anything, the current inventory levels are particularly challenging for pending deals, since those buyers are out looking for homes right now and not finding them,” he said. “Going forward, we do believe that pending sales, like closed sales, will generally track listings. If we can get more fuel for the fire, we will likely be able to keep the flames going through the end of the year. Even with rates increasing, buyer demand is incredibly strong, and we believe that buyers will simply adapt to a higher rate environment by switching to adjustable-rate mortgages or raising their down payments.”

Rand noted that the first quarter closed transactions does not reflect the higher interest rates and that at present, sales are lower not because of the lack of demand, but due to record low inventory,

He added, “I think what we are seeing is (prospective) sellers who don’t want to put their home on the market until they find something to buy and there is just not a lot of stuff to buy, so it’s like this recurring cycle whereby no one puts their home on the market because no one else has put their home on the market.”

Rand said that buyer demand is still strong and if more listings come on the market, sale price appreciation will moderate.

Houlihan Lawrence officials were upbeat on both the conventional and luxury suburban markets in 2022. Liz Nunan, President and CEO of Houlihan Lawrence, said, “There are external factors that can always affect a real estate market. Still, today’s supply and demand ratio indicate that the market will remain a strong seller market for the foreseeable future. If a house is lingering on the market under these conditions, it is very likely the price.”

Anthony P. Cutugno, Senior Vice President, Director of Private Brokerage for Houlihan Lawrence, noted, that suburban luxury home sales in 2020 and 2021 reached record-breaking sales. He said it is unlikely that the pace achieved during the past two years will continue unabated unless supply of luxury homes significantly increases.

Cutugno noted the low supply/high demand environment has generated stiff competition for a dwindling number of listings. Multiple offers have pushed up median selling prices. For example, in Westchester, approximately 38% of first quarter luxury sales closed at a premium over list price—the highest being $1 million above asking price.

He related that the majority of Westchester’s first quarter luxury sales closed below the asking price. “Savvy buyers will overlook unrealistically priced listings to the benefit of well-priced and well-presented homes that are selling more quickly than last year. If a listing is languishing on the market, it is often a sign that pricing should be revisited to capitalize on this robust, but not always euphoric, market,” Cutugno said.

Receive original business news about real estate and the REALTORS® who serve the lower Hudson Valley, delivered straight to your inbox. No credit card required.