BRI Says Westchester Rent Hike Falls Short; Warns of Long-Term Consequences

BRI officials stated that while the new increases prevent another destructive rent freeze, they once again fall short of what is required to keep up with rising costs.

WASHINGTON—The National Association of Hispanic Real Estate Professionals released the 12th publication of its annual State of Hispanic Homeownership Report on March 16 on the final day of NAHREP’s National Convention & Housing Policy Summit in Washington D.C.

The report found that in 2021, the Hispanic homeownership rate increased to 48.4%, consistent with the trendline of the past seven years—an average increase of nearly one percentage point every two years. This positive-growth came despite a hostile real estate market, particularly harsh for low-wealth first-time homebuyers who rely on low down payment loan products, the report stated.

“While the homeownership rate for Hispanics continues its upward trajectory, recent market conditions have made it challenging for new homebuyers, particularly those who rely on low down payment products,” said Gary Acosta, NAHREP Co-Founder & CEO. “Housing inventory dipped to record low levels, and rising price points pushed homeownership out of reach for many first-time buyers. A failure to address the housing supply crisis could result in a steep decline in the overall homeownership rate and a devastating impact to the nation’s GDP and economic well-being.”

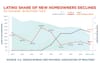

While Latinos accounted for the majority of homeownership growth between 2011 and 2017, the proportional share of new homeowners attributed to Latinos decreased from its peak of 68.0% in 2015 to 18.1% in 2021. This slowdown coincides with the lowest rates of housing inventory in history. Given the relative youth of the Latino community, coupled with population and labor growth projections, the country will increasingly depend on Latinos to carry U.S. homeownership growth, NAHREP officials stated.

Among the report’s highlights include:

Sustained Homeownership Growth Consistent with Seven-Year Trendline—In 2021 the Hispanic homeownership rate increased to 48.4%, up from 47.5% in 2019. Since 2019, Latinos added a net total of 657,000 owner households.

Latinos Accounted for Lower Share of Homeownership Growth and Household Formations—Latinos accounted for 20.6% of homeownership growth since 2017, compared to 78.5% of homeownership growth between 2011 and 2017. Since 2017, the non-Hispanic White population created a record 2.7 million net new households, accounting for 41.5% of new household formations. This is in contrast with earlier in the decade when Latinos made up the largest share of household formation growth.

Hostile Market for First-Time Homebuyers Using Low Down Payment Products—Latinos are twice as likely to use Federal Housing Administration (FHA) financing, yet FHA borrowers faced a competitive disadvantage in last year’s tight housing market. Nearly half (44%) of respondents in NAHREP’s 2021 Top Real Estate Practitioners Survey reported working with FHA clients to switch them to conventional and 17% reported that FHA borrowers gave up on their home search and continued renting. In 2020, Latino homebuyers were 81% more likely to be denied for a conventional loan than their non-Hispanic White counterparts.

Housing Inventory—In all the most populous Latino markets, housing underproduction significantly worsened, and an increase in institutional housing acquisitions has exacerbated the entry-level housing shortage. In the third quarter of 2021, at least 23% of properties in the top 20 most populous Latino counties were purchased by investors and several markets experienced investor purchase shares as high as 38% to 39%.

Regional Insights—Between 2019 and 2021, the San Bernardino and Riverside counties in California, locally known as the Inland Empire, produced the most new Latino homeowners. And, in the midst of a housing inventory and affordability crisis, Texas, Arizona and Tennessee saw the greatest influx of Latinos in 2021, and California saw the greatest decrease in net migration.

Opportunities For Growth—40.8% of Latinos aged 45 and younger who don’t already have a mortgage are considered mortgage ready. When accounting for the number and share of mortgage ready Latinos, affordability, and housing stock availability, the McAllen, El Paso and Brownsville, TX markets offer the greatest opportunity for growth. Additional opportunity markets that topped the list were Las Cruces, NM in the Southwest, Memphis, TN in the South and Cleveland, OH in the Midwest.

As Country Ages, Dependency on Latinos Grows—Between 2020 and 2040 Latinos are predicted to account for 53.1% of household formations, while the number of non-Hispanic White households is predicted to decline. Latinos are predicted to account for 78% of net new workers between 2020 and 2030.

Receive original business news about real estate and the REALTORS® who serve the lower Hudson Valley, delivered straight to your inbox. No credit card required.