Judge’s Ruling Blocks Fed’s Push to Kill Congestion Pricing in New York City

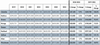

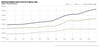

The congestion pricing program was instituted in January 2025 and during its first year in operation, congestion pricing raked in more than $550 million for the MTA’s $15-billion capital program.