Latest news (Page 22)

Federal Court Upholds New York State’s Gas Ban Law

The court also ruled that New York’s prohibition on the installation of fossil-fuel equipment does not concern the “energy use” of covered products as defined by EPCA and is therefore not preempted.

North Castle Seeks Developers for Possible Town Hall Project

If the Town Hall renovation and expansion project moves forward, the town would interview bid respondents in September and October and possibly issue a formal Request for Proposals in November of this year.

Guest Viewpoint: New York Must and Will Embrace Advanced Nuclear Power to Fuel Our Future

If we want to power the economy of the future, we need a clean, reliable, around-the-clock source of electricity. Advanced nuclear power can deliver that.

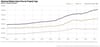

HGAR June 2025 Housing Report: Prices Hit New Highs as Market Navigates Inventory Shifts

Market dynamics continue to reflect high competition at the entry level and slower movement in the luxury tier.

OneKey MLS: NYC Regional Home Sales Fell 6% in June as Markets Faced Ongoing Inventory Constraints

Closed sales for all properties edged down 6.0% year-over-year to 3,972 transactions, with single-family home closings down 4.6%.

NAR: Existing-Home Sales Fell 2.7% in June; Northeast Sales Dropped 8% Last Month

More supply is needed to increase the share of first-time homebuyers in the coming years even though some markets appear to have a temporary oversupply at the moment.

NAR’s Yun Predicts 14% Home Sales Increase in 2026

Yun predicted that existing home sales would rise approximately 3% this year, but jump 14% higher in 2025.

Construction Begins on $85-Million Newburgh South Logistics Center Project

Neuhaus, who is a graduate of Mount Saint Mary in Newburgh, noted the long-standing issues with the property, saying, “The obituary for this site was written decades ago. You are bringing this place back to life.”

NYC Charter Review Commission Advances Ballot Proposals to Accelerate Housing and Modernize City Planning

The Charter Review Commission is also recommending the creation of an independent Land Use Appeals Board. This board would offer an alternative avenue to challenge zoning and planning decisions, creating a formal process for appeals outside of the judicial system.

GUEST VIEWPOINT: Help Us Shape Rockland’s Future!

This comprehensive update will address some of the most important issues facing our community today and tomorrow.

NAR Prevails in Homie Litigation

In a July 15 ruling, District Court Judge Dale Kimball wrote that Homie had failed to show that NAR and large brokerage companies named in the suit—Anywhere Real Estate, HomeServices of America, and RE/MAX—had conspired to cause antitrust injury to the company.

RPAC Honor Roll June

Thank you to the following Members who are leading the way in the 2025 RPAC campaign